Overview

The article titled "9 Key Benefits of Choosing a Capsule Contract Manufacturer" presents a compelling overview of the advantages associated with selecting a specialized manufacturer for capsule production within the nutraceutical industry. It highlights key benefits, including:

- Enhanced operational efficiency

- Cost savings

- Improved market adaptability

These advantages are substantiated by evidence of industry growth and underscore the critical role of strategic partnerships in achieving long-term success.

Introduction

In a landscape where the nutraceutical market is projected to soar past $762 billion by 2035, the choice of a capsule contract manufacturer can significantly impact a company's success. This article delves into nine key benefits of partnering with such manufacturers, highlighting how they streamline production, enhance product quality, and improve market responsiveness. As demand for personalized and innovative health solutions grows, businesses must consider how to leverage these partnerships to stay ahead in a competitive environment.

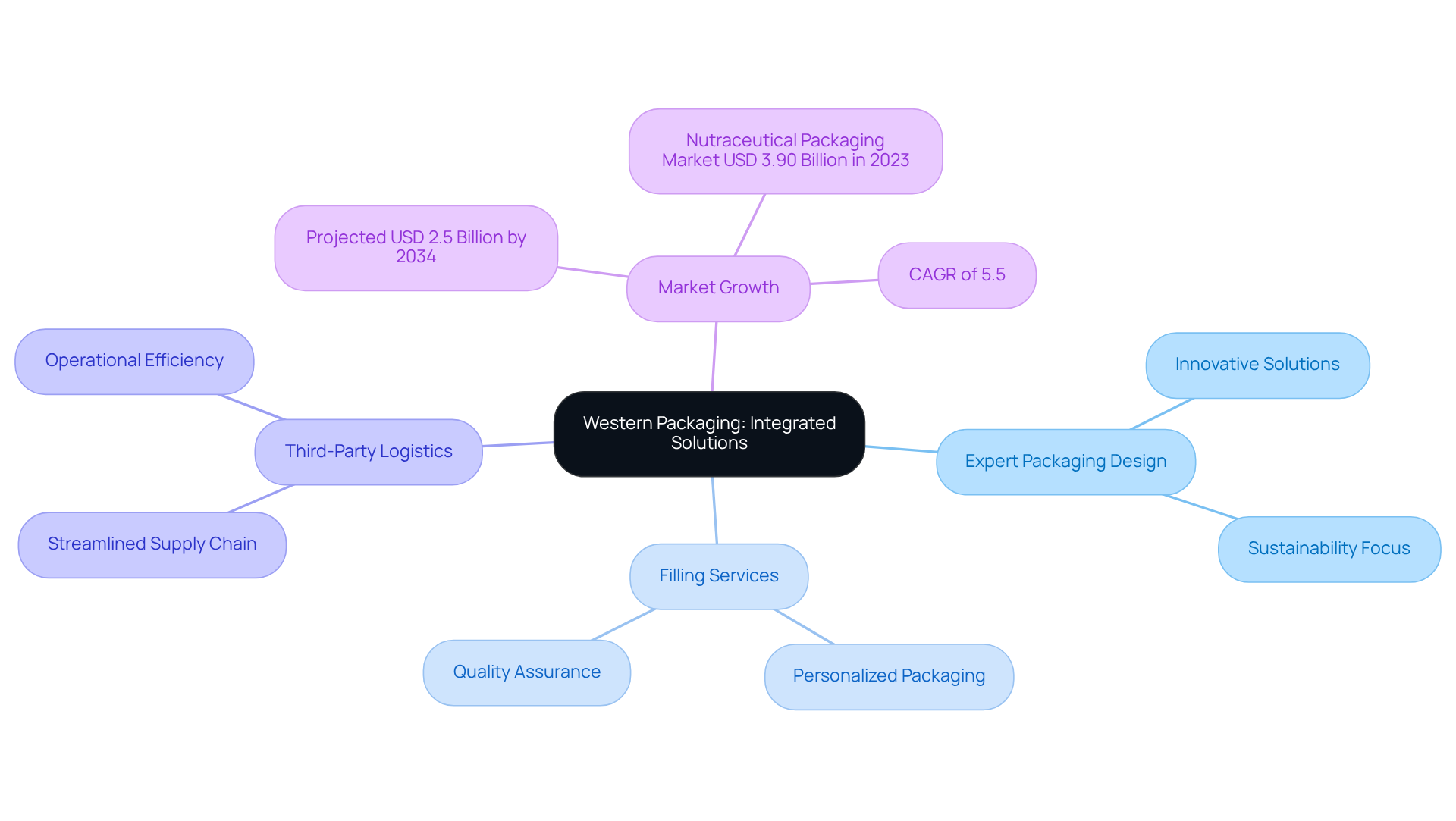

Western Packaging: Integrated Packaging Solutions for Nutraceuticals

Western Packaging presents a unique integrated method for packaging solutions tailored specifically for the health supplement industry. By merging expert packaging design, filling services, and comprehensive third-party logistics (3PL), the company provides a seamless experience that significantly enhances operational efficiency. This integration streamlines the supply chain, enabling businesses to concentrate on their core competencies while ensuring high-quality packaging and distribution.

The advantages of this integrated model are considerable. Companies utilizing integrated packaging solutions can expect improved visibility and presence, which are crucial in a competitive landscape where the dietary supplements sector is projected to exceed USD 2.5 billion by 2034, growing at a CAGR of over 5.5%. Furthermore, the global nutraceutical packaging market, valued at USD 3.90 billion in 2023, is expected to reach USD 6.24 billion by 2032, indicating a strong demand for innovative packaging solutions.

Industry leaders acknowledge the significance of this integrated approach. As experts point out, the shift towards natural and organic supplements is fueling the need for cohesive packaging strategies that not only protect item integrity but also enhance consumer engagement. Successful examples of this integration can be seen in companies like SIRIO Pharma, which made substantial investments in packaging facilities to streamline their operations and elevate their offerings.

By choosing Western Packaging, manufacturers in the health supplement sector can leverage the services of a capsule contract manufacturer to enhance the appeal of their products, ensure compliance with regulatory standards, and ultimately drive growth in a rapidly evolving market.

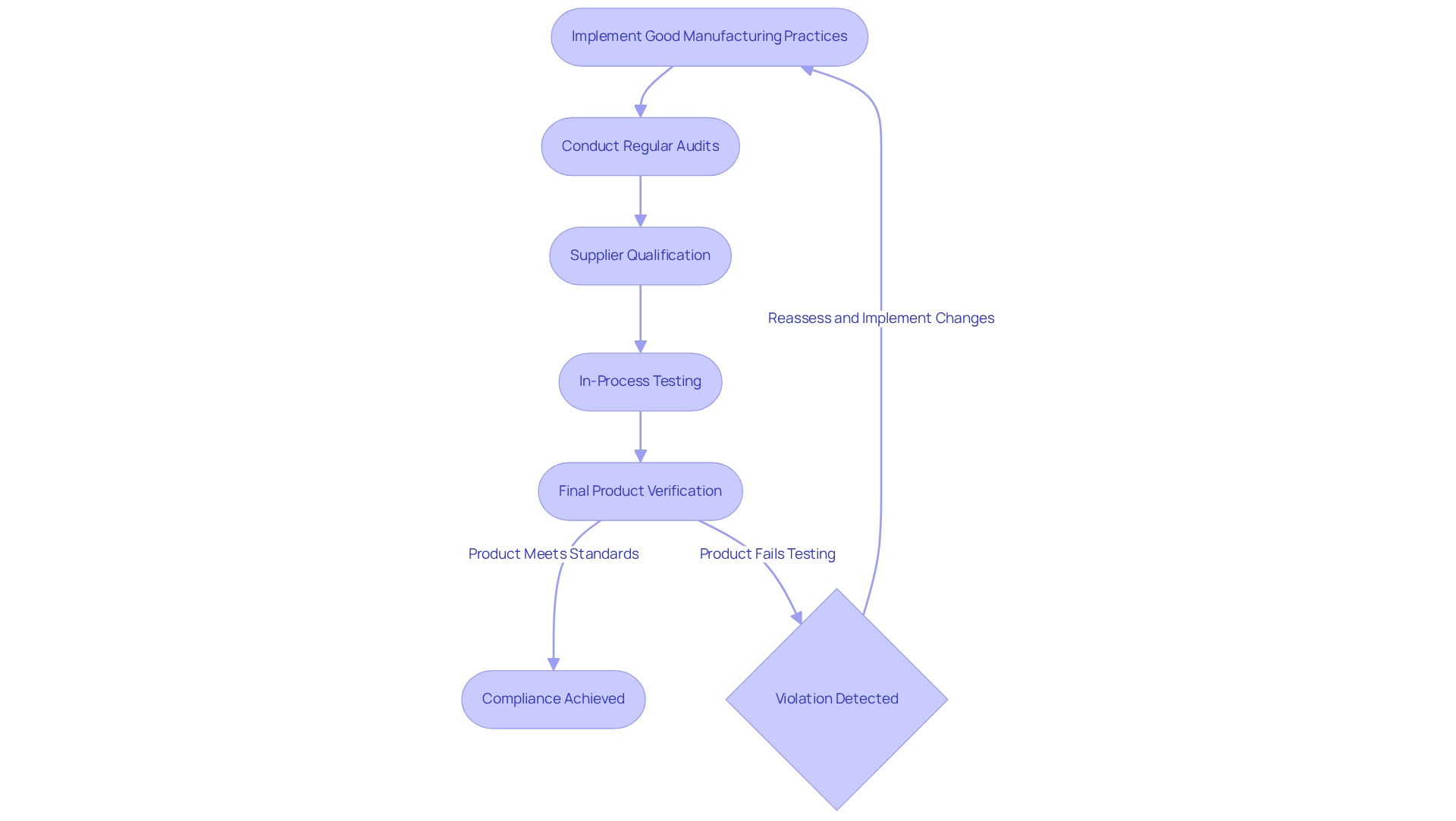

Quality Assurance: Ensuring Compliance and Safety Standards

Quality assurance in dietary supplement manufacturing is paramount for ensuring product safety and efficacy. Implementing Good Manufacturing Practices (GMP) is a fundamental requirement, as it establishes a framework for consistent quality control throughout the production process. Regular audits and adherence to GMP not only safeguard consumers but also enhance brand reputation, particularly as transparency and quality grow increasingly important to consumers.

Despite the existence of GMP regulations for over 15 years, compliance rates remain concerning, with numerous violations reported annually. For instance, the FDA issues approximately 1,600 observations and 25 warning letters each year due to non-compliance, underscoring the ongoing challenges within the industry. Companies like Sensient have demonstrated their commitment to GMP by implementing comprehensive quality assurance programs that exceed industry standards, thereby ensuring the safety and authenticity of their raw materials. Dr. Haven McCall emphasizes the necessity of thorough quality programs for brand owners and contract manufacturers to effectively manage quality-related issues.

As of 2025, the nutraceutical sector continues to face scrutiny regarding GMP compliance, with many manufacturers recognizing the necessity of robust quality management systems. This includes thorough supplier qualification, in-process testing, and final product verification to mitigate risks associated with contamination and mislabeling. By prioritizing GMP compliance and conducting regular audits alongside supplier qualification programs, manufacturers can satisfy regulatory standards while strengthening trust and loyalty among clients in a competitive market.

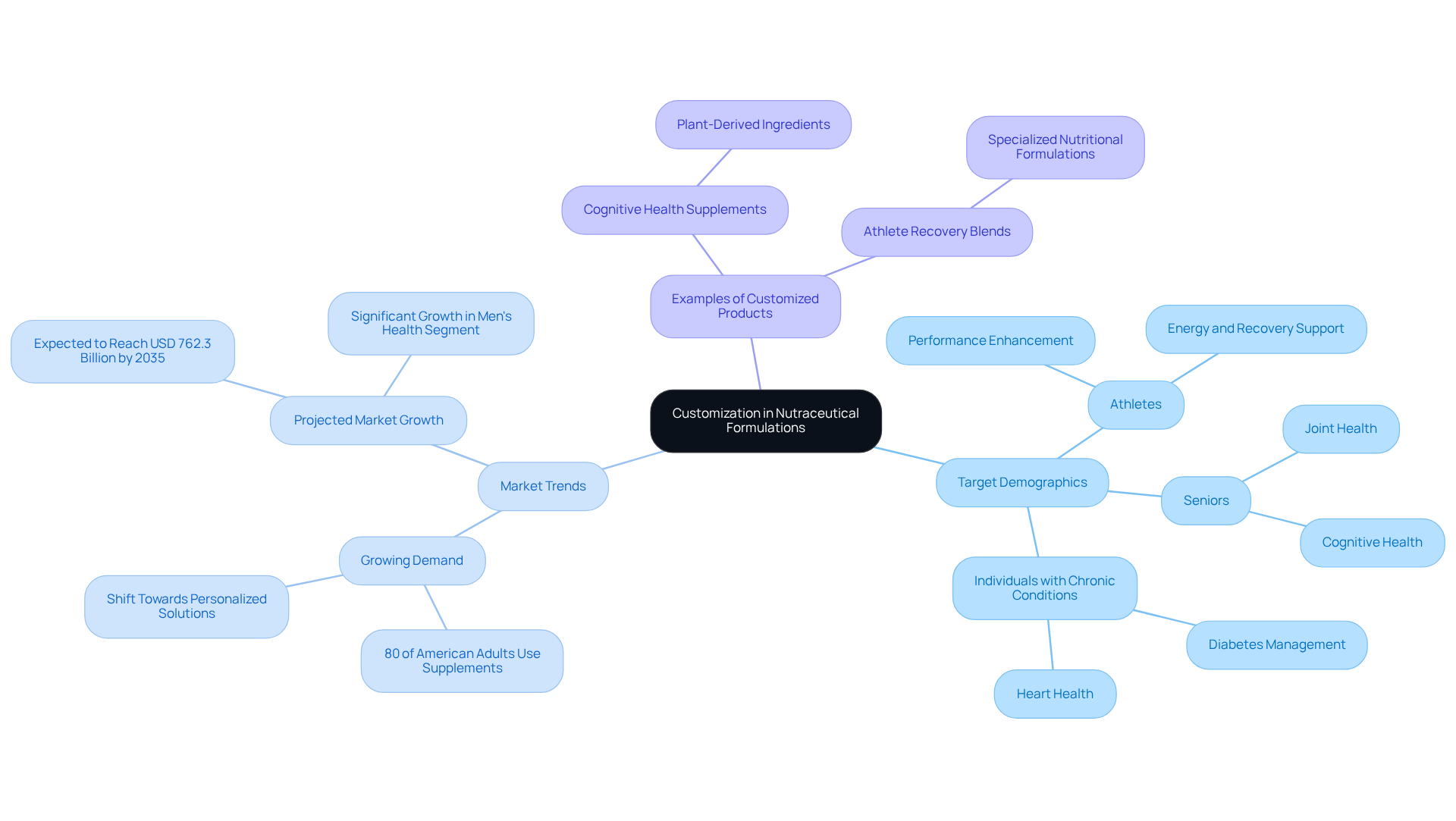

Customization: Tailoring Formulations to Meet Market Demands

Customization in nutraceutical formulations is essential for manufacturers aiming to meet specific consumer demands and preferences. By tailoring ingredients and dosages, companies can develop products that resonate with targeted demographics, such as:

- Athletes seeking performance enhancement

- Seniors focusing on joint health

- Individuals managing chronic conditions

This strategic method not only improves customer satisfaction but also establishes brands as innovators in a competitive environment.

Statistics indicate that a significant portion of consumers—approximately 80% of American adults—utilize nutritional supplements, highlighting a growing demand for personalized solutions. This trend is further underscored by the projected growth of the nutraceuticals market, expected to reach USD 762.3 billion by 2035. For instance, items created specifically for men's health are anticipated to experience substantial growth during this period, indicating a shift towards focused health management.

Examples of customized dietary supplements include:

- Formulations enriched with plant-derived ingredients aimed at cognitive health for older adults

- Specialized blends for athletes that support energy and recovery

Such targeted offerings not only meet specific health needs but also cultivate brand loyalty and trust among buyers. By aligning item development with buyer preferences, manufacturers can effectively navigate the changing environment of the health supplement industry, ensuring their offerings remain pertinent and significant. As industry specialist [Expert Name] indicates, "Customizing health supplements to satisfy customer needs is not merely a trend; it's essential for brands aiming to succeed in the current landscape.

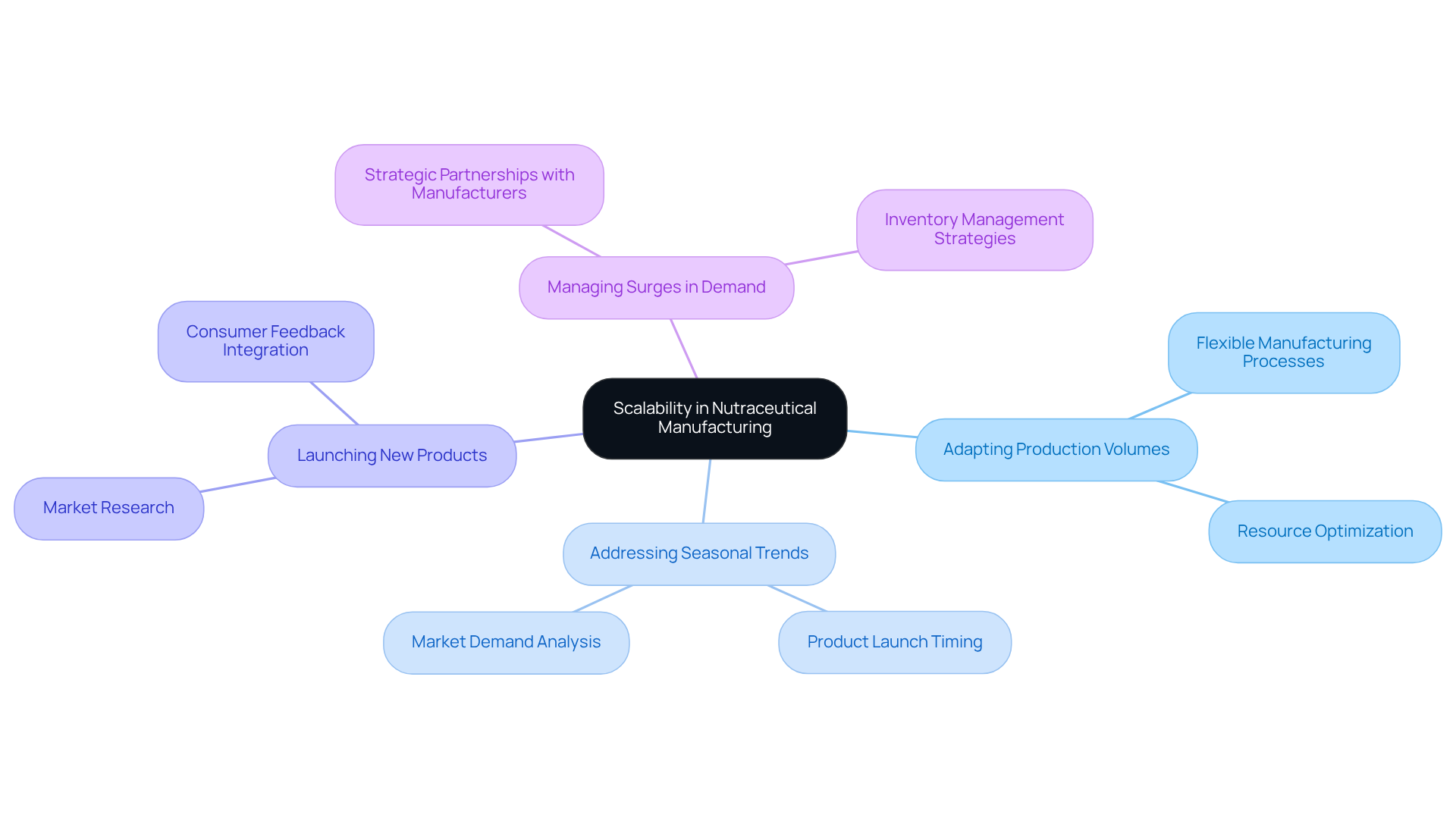

Scalability: Adapting Production to Market Needs

Scalability in nutraceutical manufacturing is crucial, enabling companies to adjust production volumes in response to market demand. This adaptability is vital for effectively addressing seasonal trends, launching new products, or managing unexpected surges in public interest.

By collaborating with a capsule contract manufacturer that provides scalable solutions, businesses can optimize their resources and minimize waste. This strategic partnership ensures that they meet consumer needs efficiently, without overcommitting to production.

Ultimately, embracing scalability not only enhances operational efficiency but also positions companies to thrive in a competitive market.

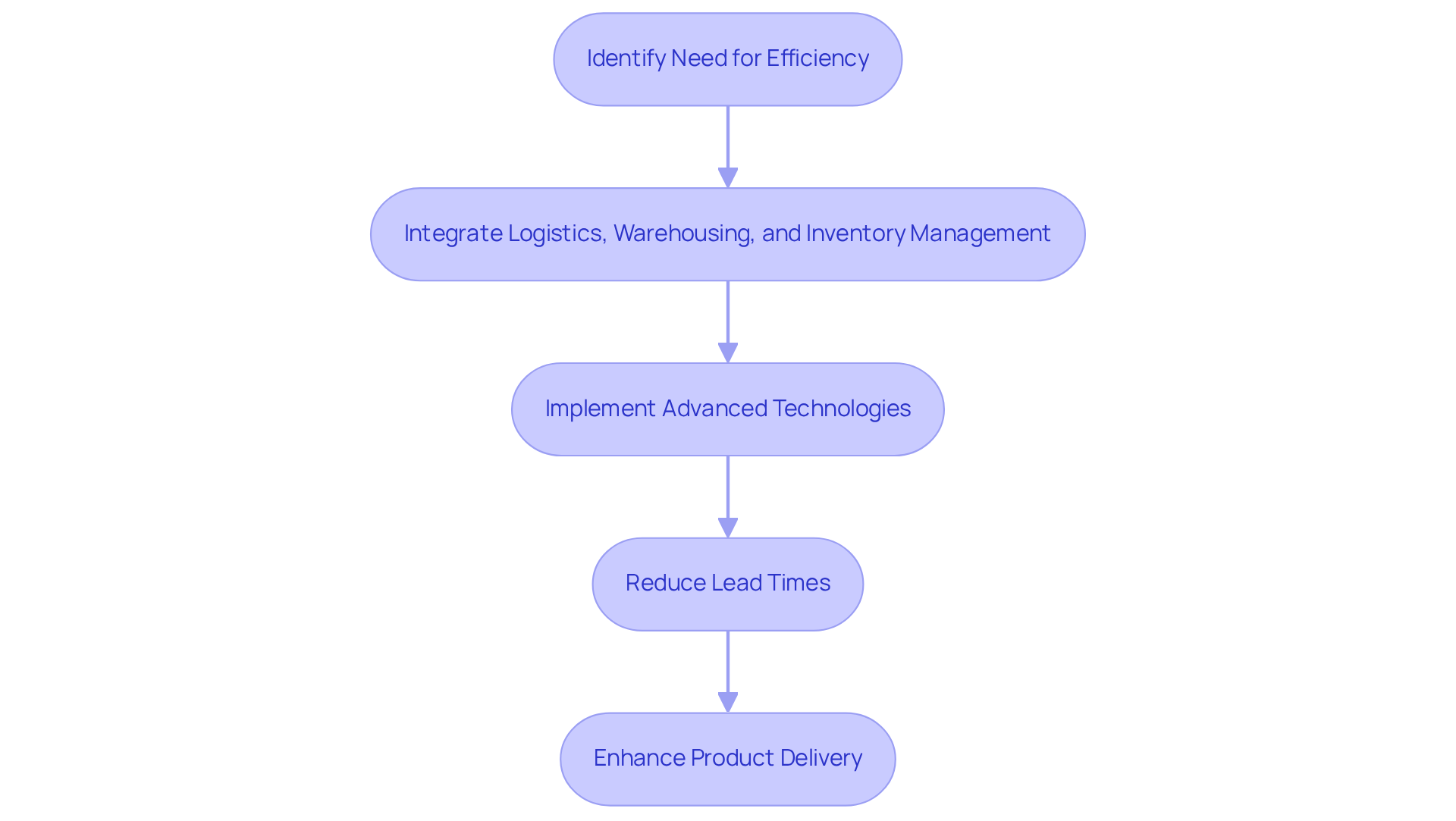

Supply Chain Management: Streamlining Operations for Efficiency

Streamlining supply chain operations is crucial for nutraceutical manufacturers who seek to enhance efficiency and reduce costs. By integrating logistics, warehousing, and inventory management, companies can ensure timely delivery of products while maintaining optimal quality. Advanced technologies, including inventory tracking systems and automated order processing, are instrumental in improving operational efficiency.

For example, manufacturers that implement these technologies can significantly decrease lead times and enhance product delivery, enabling them to focus on growth and innovation. The dietary supplement sector, projected to grow from USD 159.26 billion in 2023 to USD 329.12 billion by 2032, underscores the imperative for producers to refine their supply chains to efficiently meet rising consumer demands.

Industry experts emphasize that effective logistics and inventory management are not merely operational necessities; they are strategic advantages that can set a brand apart in a competitive market. Western Packaging's integrated approach to packaging and logistics serves as a prime example of how manufacturers can streamline operations and strengthen their market presence.

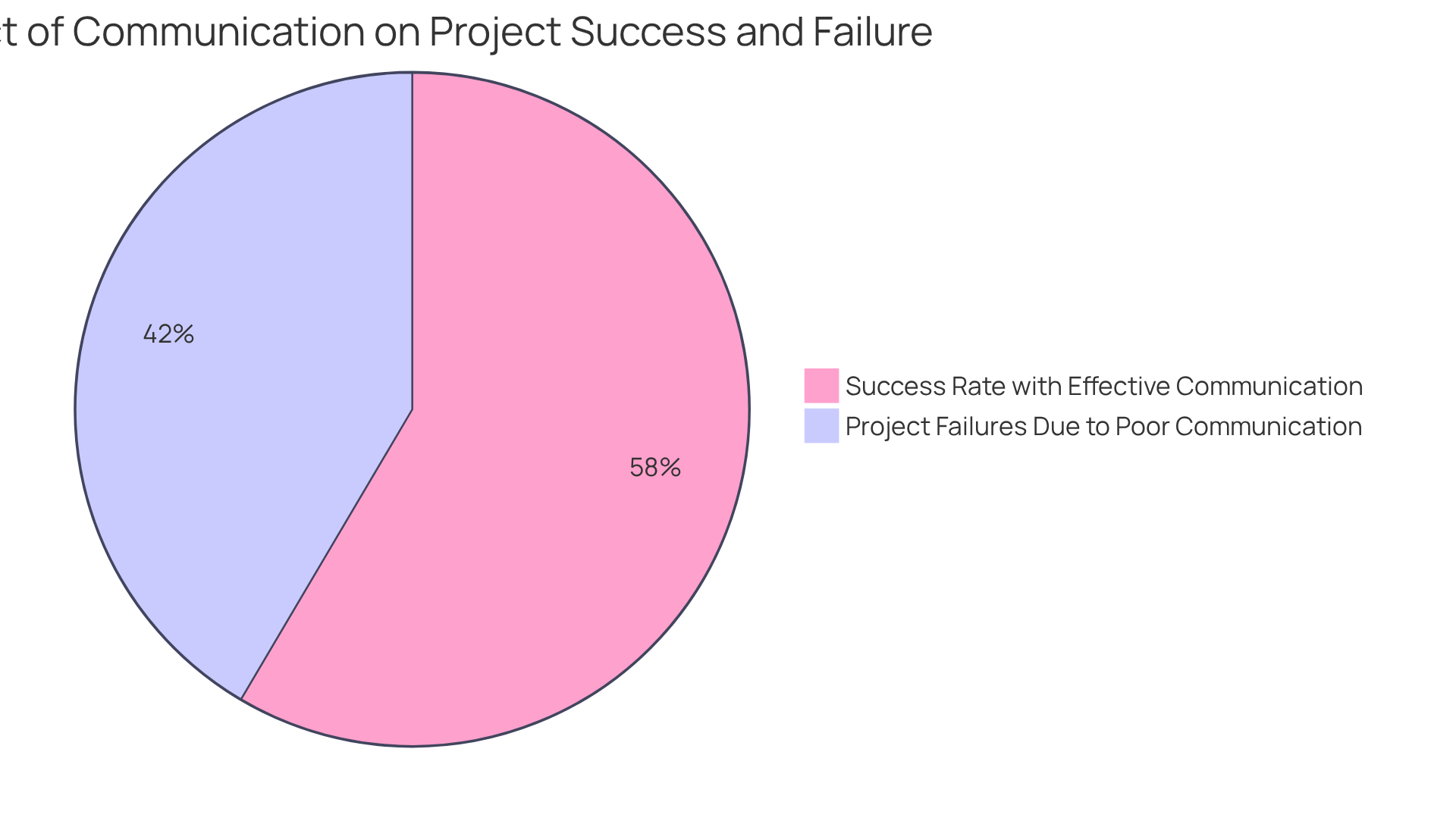

Transparent Communication: Building Trust with Your Manufacturer

Clear communication with your contract manufacturer is essential for building trust and guaranteeing project success in the health supplement industry. Regular updates regarding production timelines, quality checks, and potential issues are crucial to prevent misunderstandings and delays. By establishing clear communication channels, a collaborative environment is created where both parties can align their efforts towards common goals. This synergy not only improves quality but also significantly increases customer satisfaction.

Research indicates that teams with effective communication practices enjoy a 62% higher likelihood of project success. Additionally, 62% of respondents in Project.co’s Communication Statistics 2023 survey affirm that a good project management tool can enhance the rate of project success. Furthermore, industry leaders emphasize that nurturing open dialogue can lead to stronger relationships and improved outcomes.

Dale Malcolm, Director of TrueProject Customer Success, states, "By recognizing the importance of communication in project management, project leaders can create a positive and collaborative environment that nurtures success."

Successful collaborations in dietary supplement production often arise from a dedication to clear communication, which fosters trust and enables more seamless project execution. However, it is important to note that 44% of project professionals attribute project failure to poor communication and network among team members, highlighting the critical need for effective communication strategies.

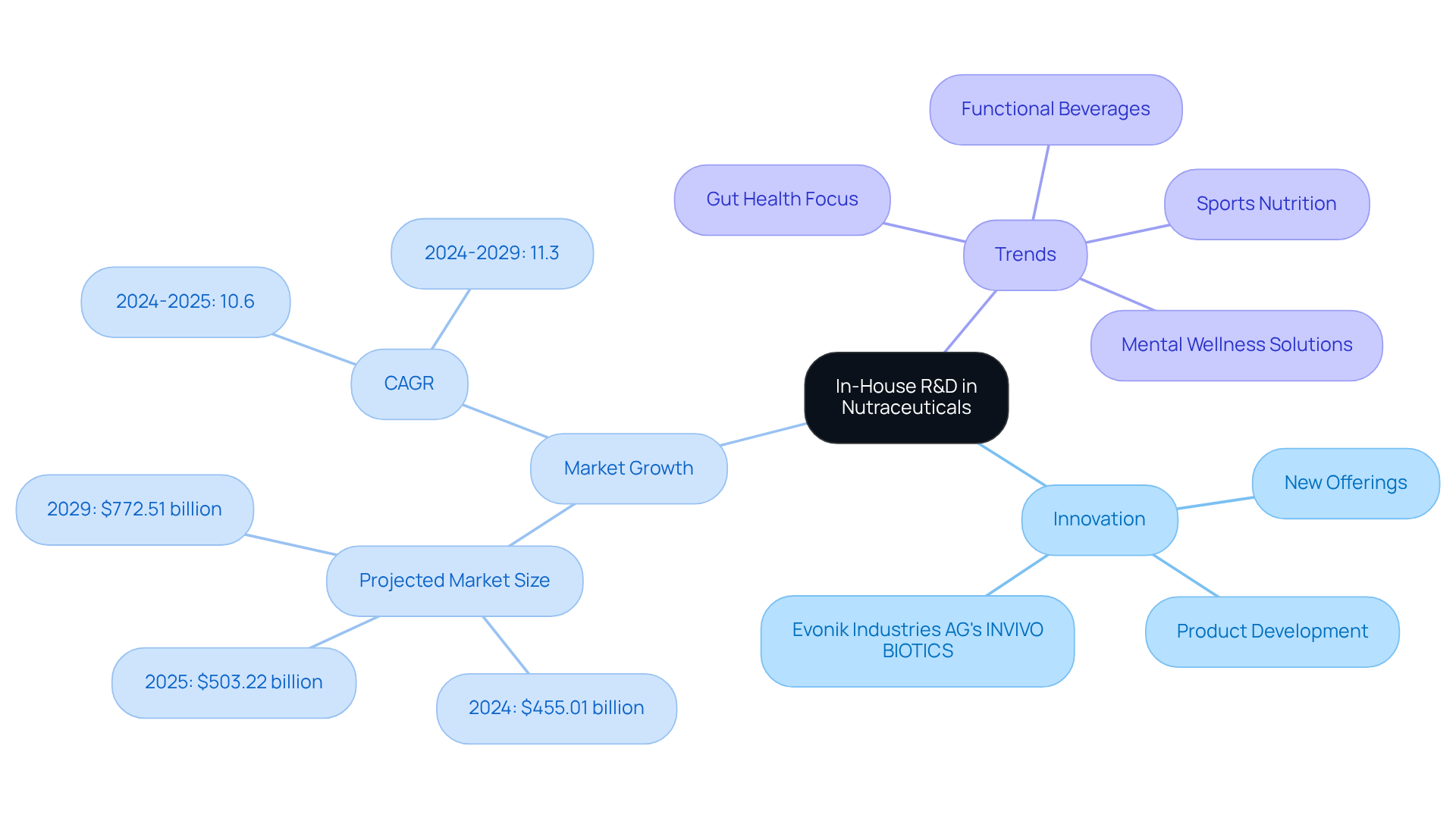

In-House R&D: Driving Innovation in Nutraceutical Products

In-house R&D capabilities are essential for manufacturers aiming to innovate and develop offerings that resonate with consumer needs. By directing funding into research, companies can explore innovative components, formulations, and delivery techniques that significantly enhance effectiveness and consumer appeal. This commitment to innovation not only distinguishes brands in a competitive landscape but also positions them as leaders in the health and wellness sector.

As highlighted, "new offering development is the key trend being pursued by the companies operating in the nutraceutical sector." The nutraceuticals market is projected to grow from $455.01 billion in 2024 to $503.22 billion in 2025, reflecting a compound annual growth rate (CAGR) of 10.6%. This growth is primarily fueled by advancements in product development, with major trends encompassing functional beverages and mental wellness solutions.

Firms leveraging internal research to create next-generation products, such as Evonik Industries AG's INVIVO BIOTICS, which integrates probiotics with additional health-enhancing components, are strategically positioned to meet the rising public focus on health and preventive care. Furthermore, the health and wellness sector is anticipated to reach $218.1 billion by 2025, underscoring the critical role of innovation through R&D as a key differentiator for successful dietary supplement brands.

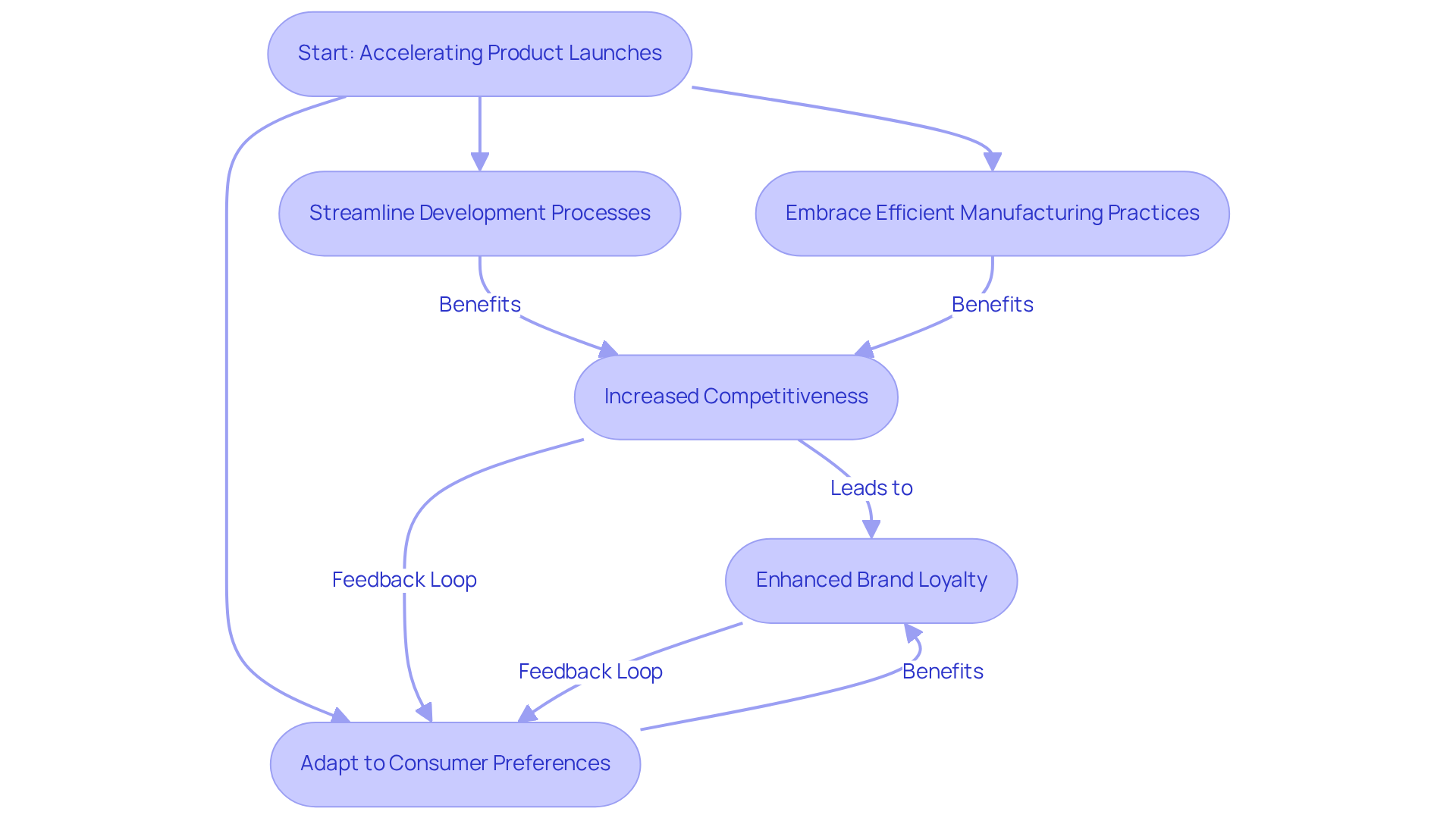

Speed to Market: Accelerating Product Launches

In the rapidly evolving nutraceutical sector, accelerating time to market is essential for brands aiming to seize emerging trends and meet customer demands. By streamlining development processes and embracing efficient manufacturing practices, companies can significantly shorten the time required to launch new products. This agility not only enhances competitiveness but also allows brands to swiftly adapt to shifting consumer preferences, ensuring they remain relevant in a fast-paced environment.

For example, TopGum Industries has successfully introduced innovative gummy supplements, tapping into the rising demand for convenient and health-focused products. With the global nutraceutical industry valued at USD 458.55 billion in 2024 and projected to reach USD 762.3 billion by 2035, the focus on rapid launches becomes increasingly critical.

Current trends indicate that brands prioritizing quick development cycles are better positioned for success, as they can effectively cater to the growing public interest in personalized nutrition and functional foods. As industry experts highlight, 'The ability to launch products swiftly not only satisfies immediate consumer needs but also fosters lasting brand loyalty and trust among consumers.

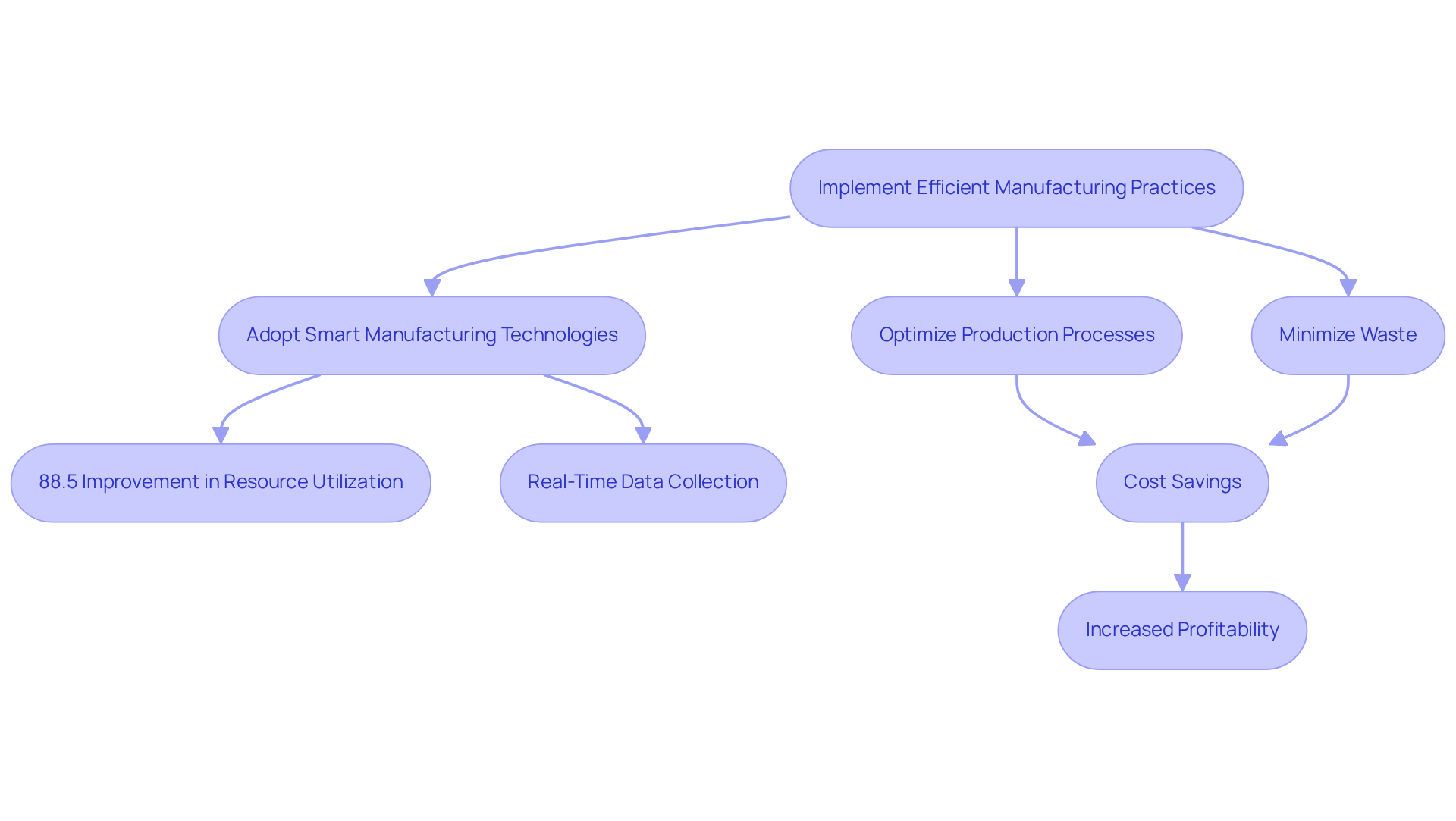

Cost Savings: Enhancing Profitability through Efficient Manufacturing

Implementing efficient manufacturing practices is crucial for nutraceutical companies aiming to enhance profitability. By optimizing production processes and minimizing waste, manufacturers can achieve substantial cost savings. Companies that adopt smart manufacturing technologies, for instance, can significantly improve productivity and reduce operational costs; West Liberty Foods achieved an impressive 88.5% improvement in resource utilization through such technologies.

Furthermore, leveraging economies of scale via bulk purchasing of raw materials not only lowers expenses but also stabilizes pricing—essential in a market where protein powder costs are rising due to increased agricultural expenses and climate change impacts. Advanced technologies also facilitate real-time data collection and analysis, enabling manufacturers to make informed decisions that drive efficiency.

This strategic approach allows companies to allocate resources more effectively, investing in marketing and development to meet the increasing consumer demand for personalized and clean-label nutraceuticals. As industry specialist Debashree Bora points out, the demand for personalized nutraceuticals is fueling the necessity for custom-formulated offerings designed for specific health needs.

Moreover, thorough testing and certifications provide a competitive edge, guaranteeing product quality and adherence in a swiftly changing environment. As the industry continues to evolve, those who prioritize efficient manufacturing will likely experience increased profitability and a stronger competitive advantage.

Long-Term Support: Ensuring Continued Success in Nutraceutical Manufacturing

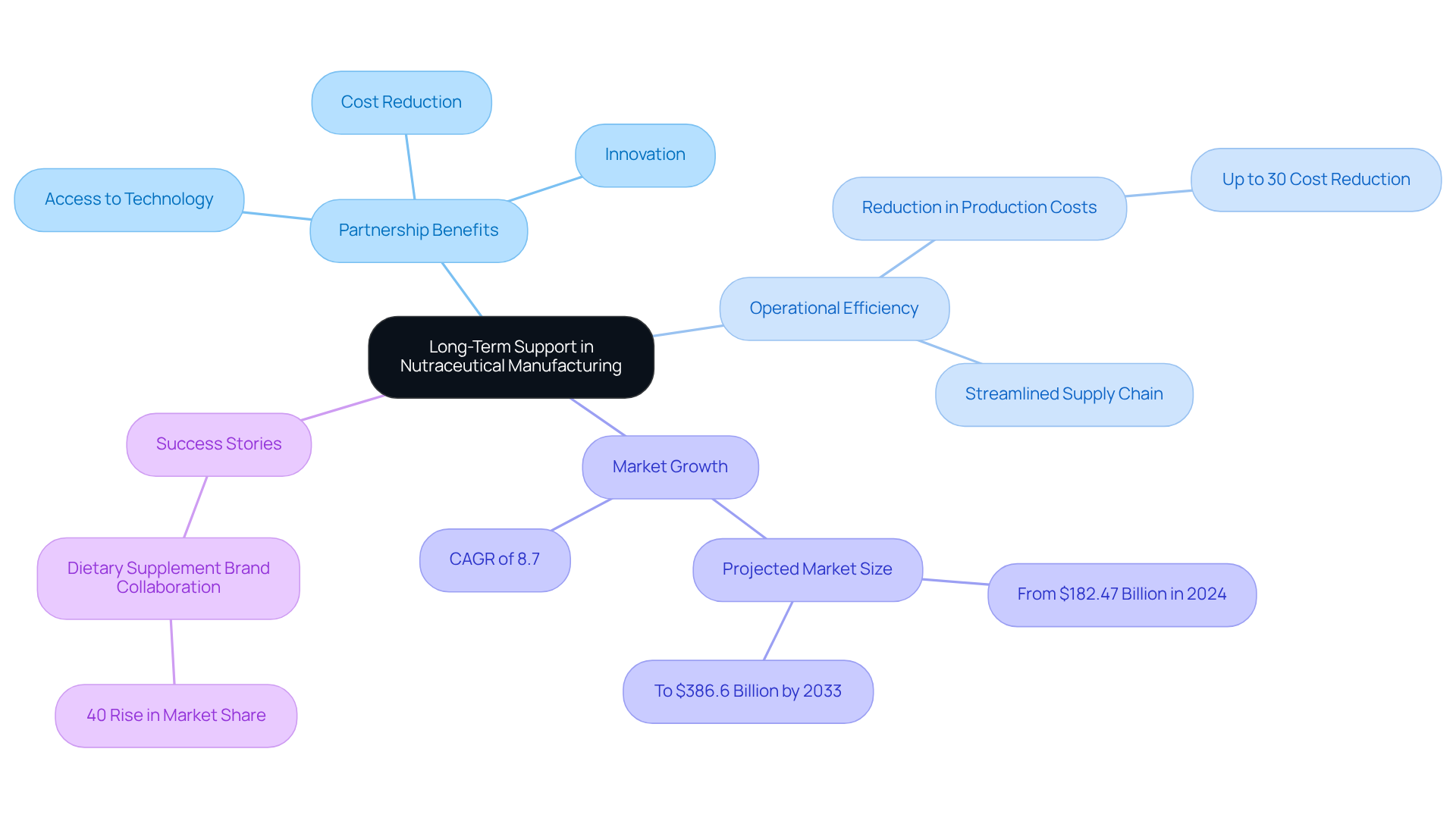

Establishing long-term partnerships with a capsule contract manufacturer is essential for achieving sustained success in the nutraceutical industry. These collaborations provide companies with ongoing support, access to cutting-edge technologies, and valuable insights into evolving market trends. By fostering open dialogue and teamwork, companies can quickly adjust to evolving consumer needs, ensuring their offerings remain competitive and relevant.

Statistics reveal that companies leveraging a capsule contract manufacturer experience a significant boost in operational efficiency, with many reporting a reduction in production costs by up to 30%. Furthermore, long-term partnerships foster innovation, as manufacturers often share research and development resources, enabling brands to introduce new products more rapidly. The capsule contract manufacturer sector for health products is expected to expand from $182.47 billion in 2024 to $386.6 billion by 2033, with a CAGR of 8.7%, emphasizing the significance of strategic alliances in capitalizing on this growth.

Successful collaborations in the nutraceutical sector illustrate these benefits. For instance, a prominent dietary supplement brand collaborated with a capsule contract manufacturer to create a new range of clean-label offerings, leading to a 40% rise in market share within a year. This partnership not only enhanced product quality but also streamlined the supply chain, significantly reducing lead times.

Experts emphasize that maintaining strong relationships with contract manufacturers is vital. As Kristine Halliwell, a purchasing director, noted, "The best way to manage supply networks today is to have strong and trustworthy relationships with suppliers, to plan ahead as much as possible, and to always have a solid back-up plan in case issues do arise." Such insights underscore the critical role of collaboration in navigating the complexities of the nutraceutical market, ultimately driving growth and success.

Conclusion

Choosing a capsule contract manufacturer presents a multitude of advantages that can significantly enhance the operational effectiveness and market positioning of health supplement brands. By integrating various services such as packaging, quality assurance, and research and development, companies can streamline their processes, ensuring high-quality products that efficiently meet consumer demands.

Key benefits include:

- Customization

- Scalability

- Transparent communication

All of which are crucial in fostering innovation and building trust between manufacturers and their clients. Moreover, adherence to quality standards and effective supply chain management is essential for navigating the competitive nutraceutical landscape.

As the nutraceutical market continues to expand, leveraging the expertise of a capsule contract manufacturer becomes increasingly vital. Companies prioritizing collaboration and innovation can meet the evolving needs of consumers and position themselves as leaders in a rapidly changing industry. Embracing these strategic partnerships will ultimately drive growth, enhance profitability, and ensure long-term success in the health supplement sector.

Frequently Asked Questions

What integrated packaging solutions does Western Packaging offer for the nutraceutical industry?

Western Packaging provides a unique integrated method that combines expert packaging design, filling services, and comprehensive third-party logistics (3PL) tailored specifically for the health supplement industry, enhancing operational efficiency.

What are the benefits of using integrated packaging solutions in the nutraceutical sector?

Companies can expect improved visibility and presence in a competitive market, allowing them to focus on core competencies while ensuring high-quality packaging and distribution, which is crucial as the dietary supplements sector is projected to exceed USD 2.5 billion by 2034.

How is the global nutraceutical packaging market expected to grow?

The global nutraceutical packaging market, valued at USD 3.90 billion in 2023, is anticipated to reach USD 6.24 billion by 2032, indicating a strong demand for innovative packaging solutions.

Why is quality assurance important in dietary supplement manufacturing?

Quality assurance is crucial for ensuring product safety and efficacy. Implementing Good Manufacturing Practices (GMP) establishes a framework for consistent quality control, safeguarding consumers and enhancing brand reputation.

What challenges does the dietary supplement industry face regarding GMP compliance?

Despite GMP regulations existing for over 15 years, compliance rates remain low, with the FDA issuing approximately 1,600 observations and 25 warning letters annually due to non-compliance.

What strategies can manufacturers adopt to improve GMP compliance?

Manufacturers can implement robust quality management systems, including thorough supplier qualification, in-process testing, and final product verification, to mitigate risks associated with contamination and mislabeling.

How does customization play a role in nutraceutical formulations?

Customization allows manufacturers to tailor ingredients and dosages to meet specific consumer demands, improving customer satisfaction and establishing brands as innovators in a competitive environment.

What trends indicate the growing demand for personalized nutraceutical solutions?

Approximately 80% of American adults utilize nutritional supplements, and the nutraceuticals market is projected to reach USD 762.3 billion by 2035, highlighting the need for personalized solutions.

Can you provide examples of customized dietary supplements?

Examples include formulations enriched with plant-derived ingredients for cognitive health in older adults and specialized blends for athletes to support energy and recovery.

What is the significance of aligning product development with consumer preferences in the health supplement industry?

Aligning product development with consumer preferences helps manufacturers navigate the changing environment of the health supplement industry, ensuring their offerings remain relevant and significant.