Overview

The primary focus of the article titled "9 Key Packaging Sustainability Trends for Nutraceutical Manufacturers" is to delineate the significant trends in sustainable packaging practices that nutraceutical manufacturers must adopt. The article elaborates on various strategies, including:

- Circular packaging

- Compostable materials

- Minimalist designs

- Smart technologies

These approaches are all designed to mitigate environmental impact while satisfying consumer demand for sustainable products. This underscores the imperative for manufacturers to align with these evolving market expectations.

Introduction

The nutraceutical industry is experiencing a profound transformation, with sustainability emerging as a pivotal focus for manufacturers. As consumers increasingly prioritize eco-friendly practices, the demand for innovative packaging solutions is surging. This article explores nine key trends that are shaping the future of packaging sustainability in the nutraceutical sector. It highlights how companies can not only meet regulatory standards but also enhance their brand image and foster consumer trust. As the landscape continues to evolve, what strategies will nutraceutical manufacturers implement to maintain a competitive edge in this dynamic market?

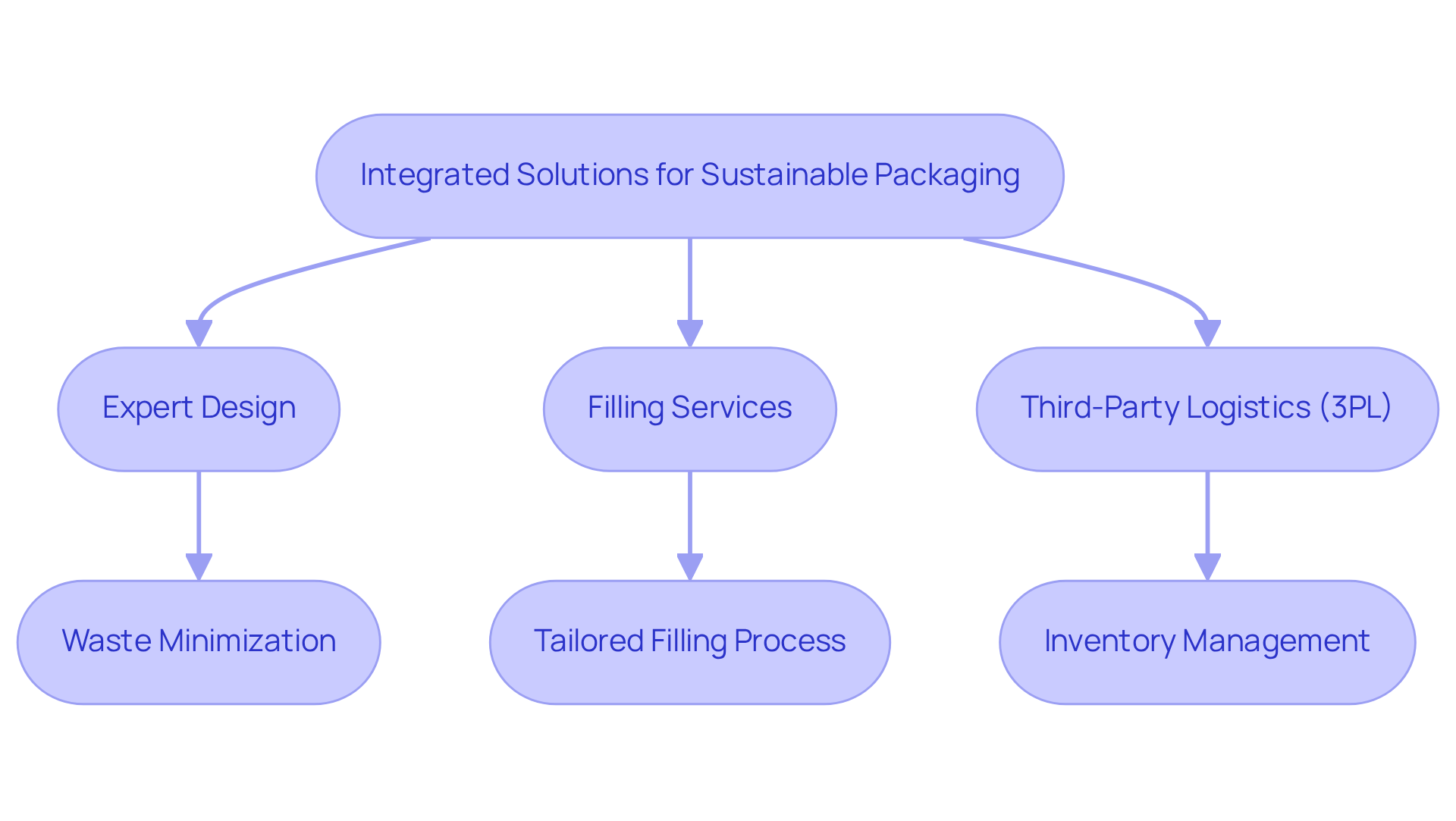

Western Packaging: Integrated Solutions for Sustainable Packaging

Western Packaging distinguishes itself in the nutraceutical industry through integrated solutions that seamlessly combine expert design, filling services, and third-party logistics (3PL). Our filling process is tailored to accommodate a diverse range of products, from powders to gummies and soft-gels, ensuring we meet the varied needs of producers. This comprehensive strategy not only optimizes the supply chain but also integrates packaging sustainability trends as a core component of the process.

By managing the entire lifecycle of packaging—from initial design to final distribution—Western Packaging enables manufacturers to minimize waste and enhance operational efficiency. Our extensive 3PL services, including warehousing and inventory management, further streamline the supply chain, allowing businesses to concentrate on their core competencies.

The nutraceutical container market is projected to reach USD 4.66 billion by 2030, growing at a CAGR of 4.9%. As consumers become increasingly health-conscious and environmentally aware, the demand for sustainable containers is expected to rise, reflecting the packaging sustainability trends. This alignment with evolving market demands underscores the necessity of integrated solutions, like those offered by Western Packaging, for producers striving to meet buyer expectations and regulatory standards.

Circular Packaging Solutions: Reducing Waste and Enhancing Sustainability

Circular wrapping solutions are engineered to minimize waste by ensuring that materials can be reused, recycled, or composted. For nutraceutical producers, the adoption of circular containers not only mitigates environmental impact but also reflects packaging sustainability trends that align seamlessly with consumer expectations for sustainability. By instituting systems that facilitate the return and reuse of containers, companies can markedly reduce their carbon footprint while enhancing their brand image as environmentally responsible entities.

The impact of circular containers on waste reduction is substantial. For instance, firms like SIRIO Pharma have invested €16 million in new container facilities, showcasing their commitment to sustainable practices and supporting the rising trend of circular economy initiatives. Furthermore, the packaging sustainability trends are gaining traction globally through Extended Producer Responsibility (EPR) initiatives, encouraging producers to adopt recyclable and reusable materials, thereby fostering a culture of sustainability within the sector.

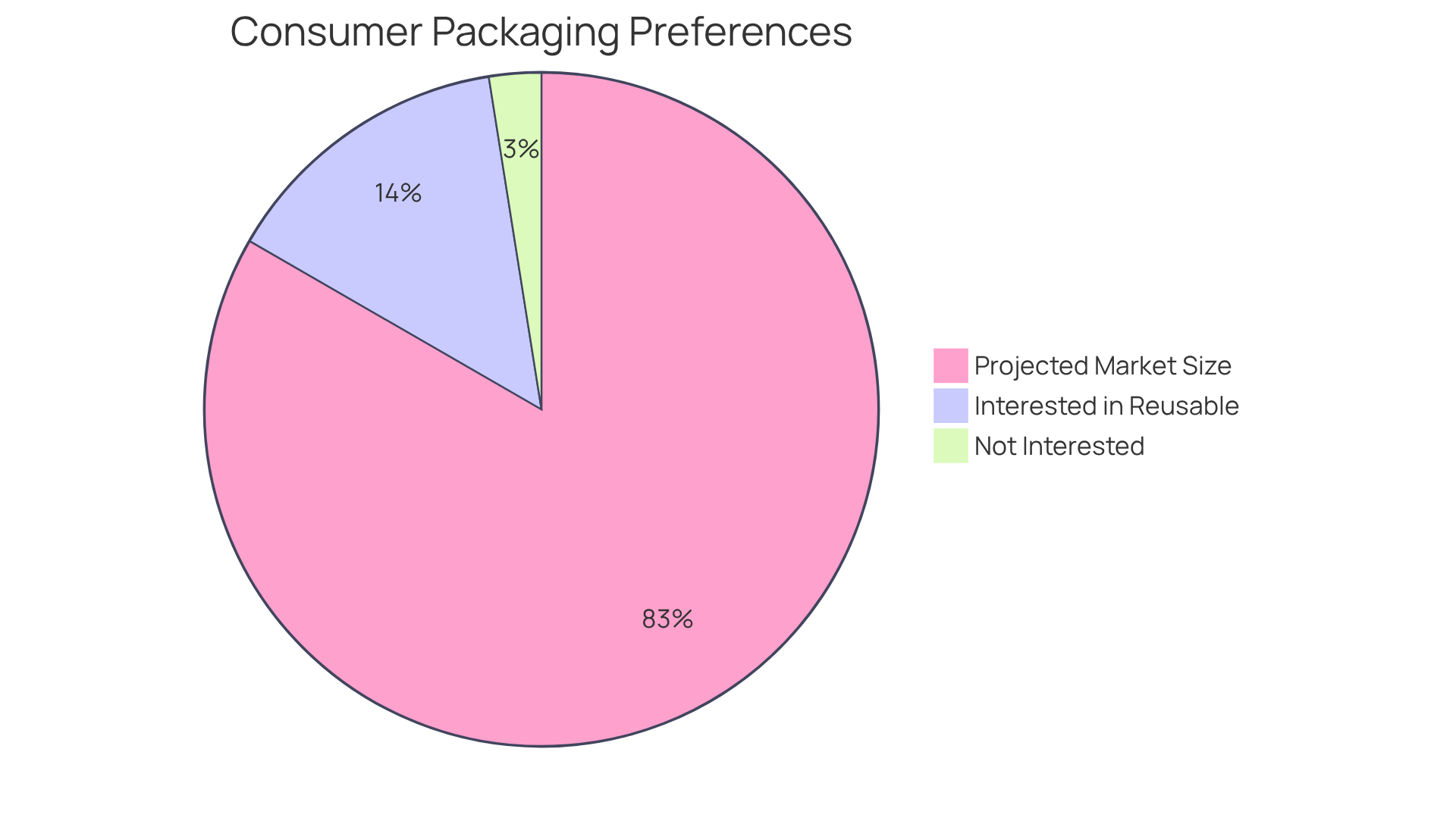

Experts highlight the significance of these innovations, noting that 85% of consumers indicate an interest in purchasing products packaged in reusable materials (Consumer Brands/Ipsos). With the circular container market projected to expand at a CAGR of 7.3% from 2025 to 2034, reaching USD 499.8 billion by 2034, it is clear that the packaging sustainability trends are not merely a trend but a crucial evolution in the health supplement sector. By embracing these practices, manufacturers can play a pivotal role in waste reduction and the promotion of a healthier planet.

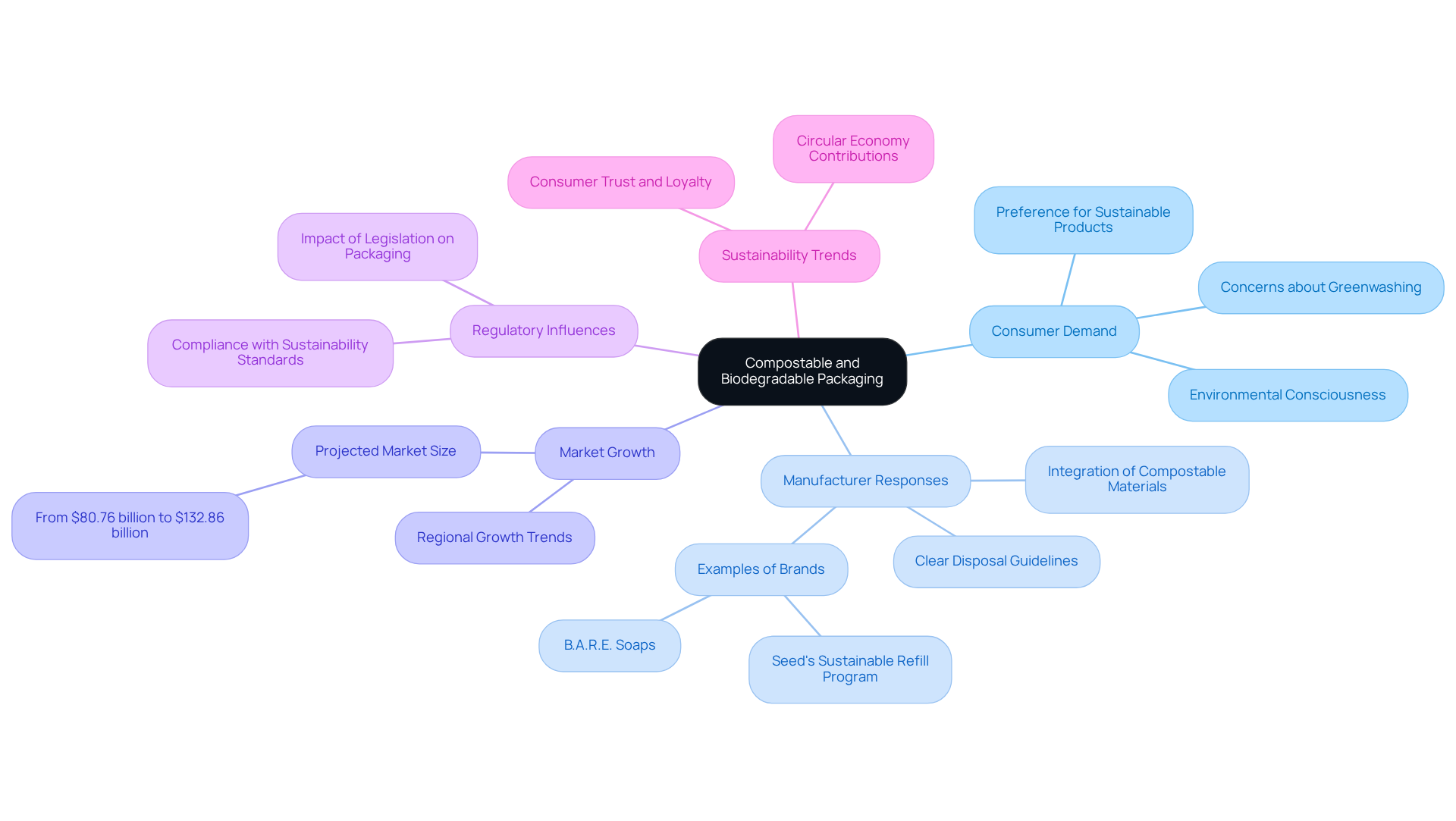

Compostable and Biodegradable Packaging: Meeting Consumer Demand

As environmental consciousness continues to grow, the demand for compostable and biodegradable materials is significantly increasing within the nutraceutical sector. Manufacturers are responding by integrating materials that decompose naturally, thereby minimizing landfill waste. By utilizing compostable materials, brands not only cater to eco-aware buyers but also enhance their market distinction. This strategic shift aligns with regulatory requirements and fosters consumer trust and loyalty, positioning brands as leaders in sustainability.

Notable examples include:

- Seed's Sustainable Refill Program, which allows customers to order larger shipments less frequently.

- B.A.R.E. Soaps, which utilize plantable seed paper materials.

Furthermore, understanding the differences between home and industrial compostable materials is crucial for effective implementation. The worldwide biodegradable container market is anticipated to expand from around $80.76 billion in 2024 to $132.86 billion by 2032, highlighting the considerable market potential for biodegradable materials.

Moreover, brands should offer clear disposal guidelines for their containers to build buyer confidence and ensure appropriate disposal. The movement towards biodegradable solutions is not merely a reaction to buyer preferences; it represents a forward-thinking approach to packaging sustainability trends and creating a sustainable future in the health supplement industry.

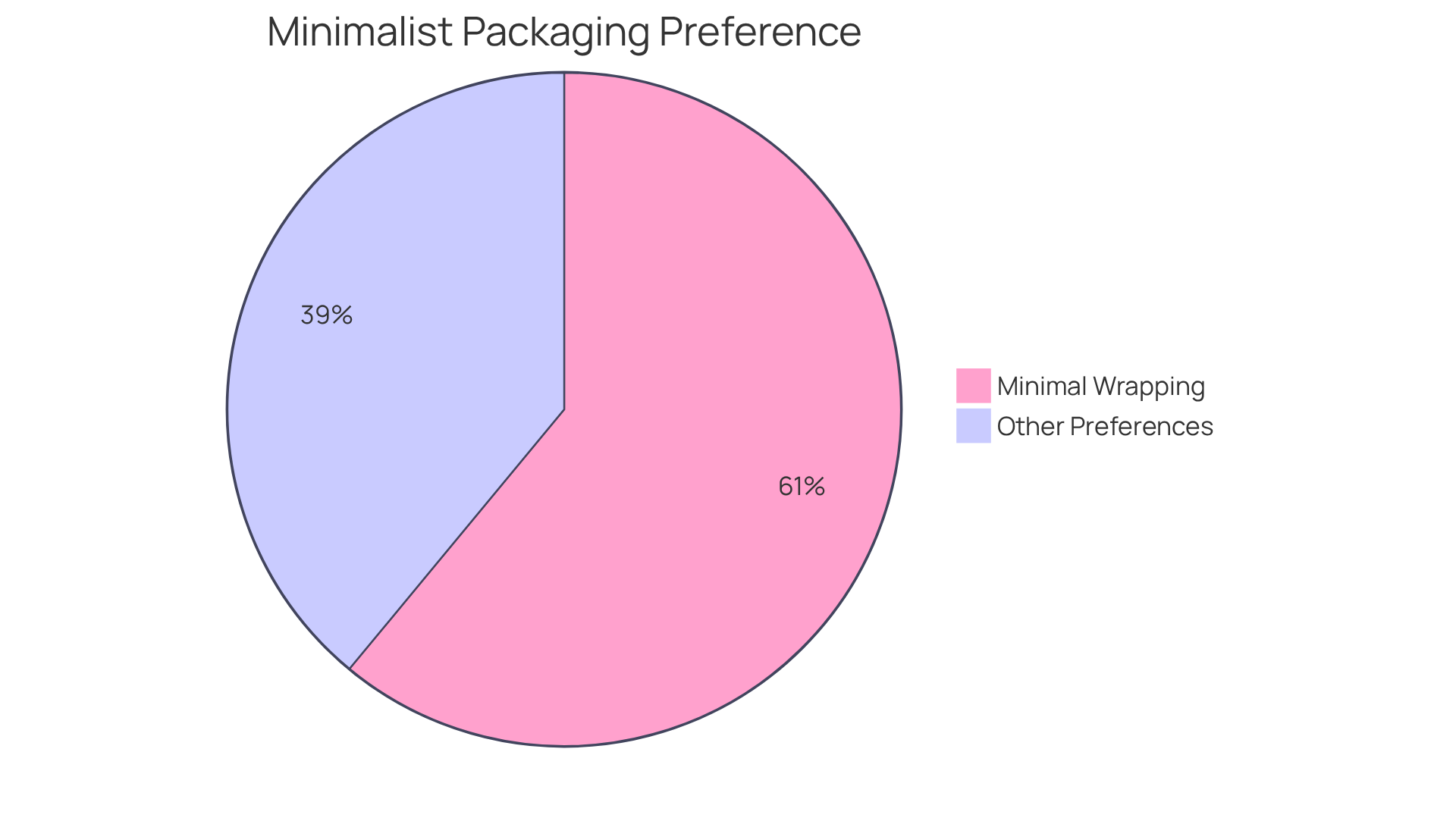

Minimalist Packaging Designs: Streamlining for Sustainability

Minimalist container designs are increasingly gaining traction in the nutraceutical industry as brands strive to minimize their environmental footprint. By implementing a streamlined approach that utilizes fewer materials, companies can significantly reduce production costs while appealing to consumers who favor simple, eco-friendly options. This design philosophy not only conserves essential resources but also enhances the visual allure of products, making them more attractive on retail shelves.

Notably, statistics reveal that 61% of buyers prioritize minimal wrapping as a desirable sustainable attribute, underscoring a shift towards simplicity and efficiency in consumer choices. As one designer aptly noted, 'Streamlined wrapping not only minimizes waste but also fosters a more engaging experience for buyers.'

This trend underscores the importance of aligning product strategies with evolving consumer preferences regarding packaging sustainability trends, ultimately cultivating brand loyalty and strengthening market presence.

In this landscape, Western Packaging sets itself apart by offering tailored flexible solutions, such as large pouches for protein products and stick packs for nutraceuticals, which not only resonate with packaging sustainability trends but also enhance product appeal and brand recognition. Through innovative container design, Western Packaging empowers supplement producers to forge a cohesive and engaging brand identity.

Reusable Packaging Systems: Promoting a Sustainable Lifecycle

Implementing reusable container systems represents a transformative strategy for nutraceutical manufacturers committed to sustainability. These systems facilitate the return of containers for reuse, significantly decreasing waste and resource consumption. By embracing a circular economy, brands not only minimize their environmental footprint but also cultivate customer loyalty through responsible practices.

Importantly, reusable containers can lead to considerable cost reductions over time, creating a mutually beneficial situation for both enterprises and customers. Statistics reveal that:

- 58% of buyers are more inclined to purchase items with reusable or recyclable containers, underscoring the growing acceptance of sustainable choices.

- 49% of U.S. consumers avoid products with excessive wrapping, highlighting the urgency of addressing consumer concerns regarding waste.

Companies such as WestRock and Recipe Unlimited are at the forefront of this movement, introducing recyclable materials and exemplifying the industry's shift towards sustainability. Their partnership to launch recyclable paperboard containers serves as a prime illustration of effective implementation.

As the market for packaging sustainability trends is projected to surpass $400 billion by 2029, the adoption of reusable packaging systems is not merely a trend but a necessary evolution in the packaging landscape. However, producers must also consider the challenges of implementing these systems, including the need for substantial changes in business practices and consumer behavior.

Clear labeling and customer education are essential for successful adoption, ensuring that clients comprehend the benefits and processes involved. To initiate the application of reusable container systems, health product manufacturers should focus on educating their customers about sustainability and the importance of returning containers for reuse.

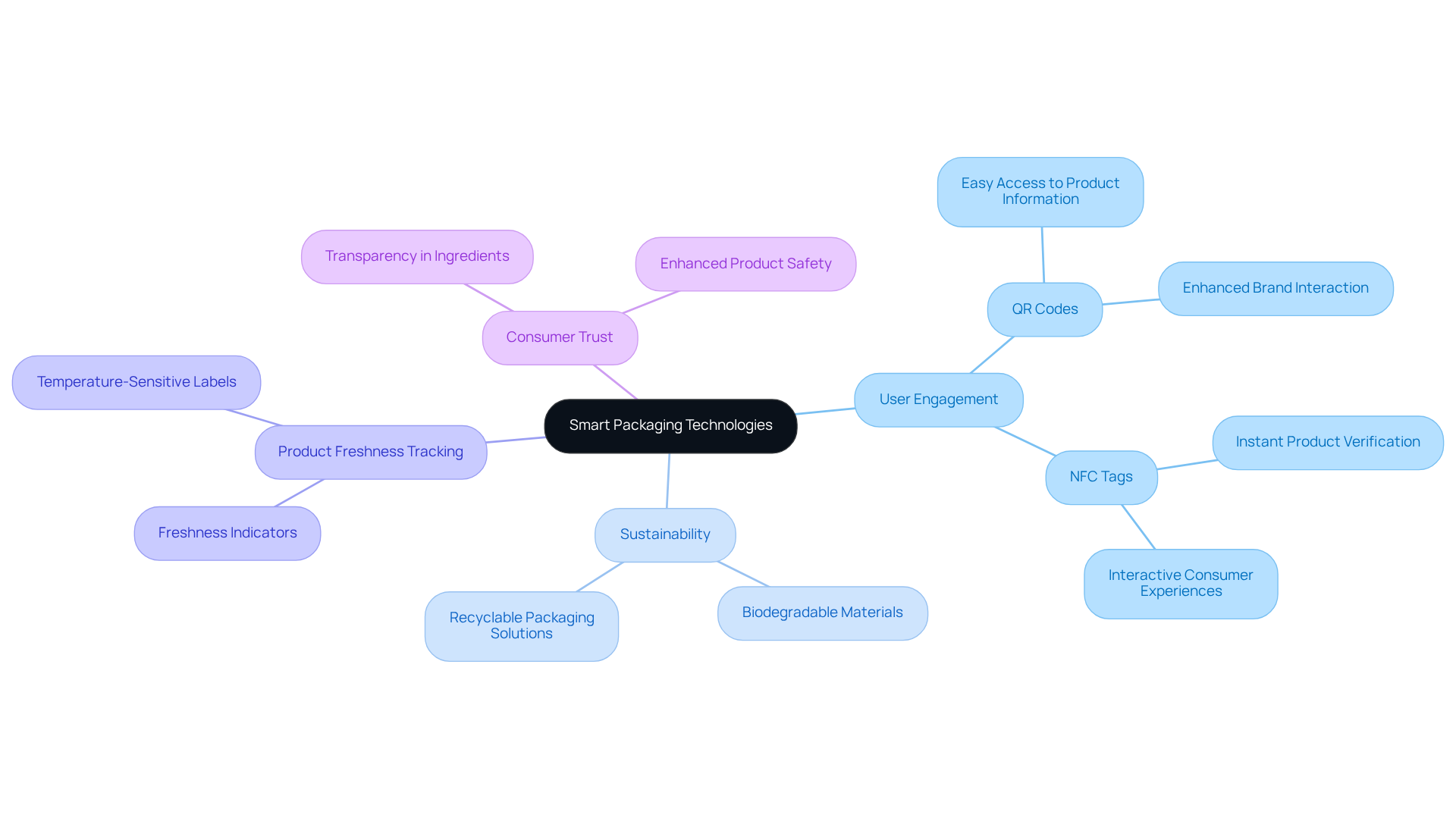

Smart Packaging Technologies: Enhancing Engagement and Sustainability

Intelligent wrapping technologies, such as QR codes and NFC tags, are revolutionizing buyer interactions with nutraceutical items. These innovations not only deliver essential information regarding product usage and sustainability but also significantly enhance user engagement.

By integrating intelligent features into their packaging, brands can effectively communicate the packaging sustainability trends, thereby cultivating a stronger connection with environmentally conscious consumers. Moreover, intelligent wrapping solutions enable tracking of product freshness and reduce waste, aligning seamlessly with packaging sustainability trends.

As the industry evolves, the adoption of these technologies is expected to become standard practice, reinforcing both consumer trust in products and brand loyalty.

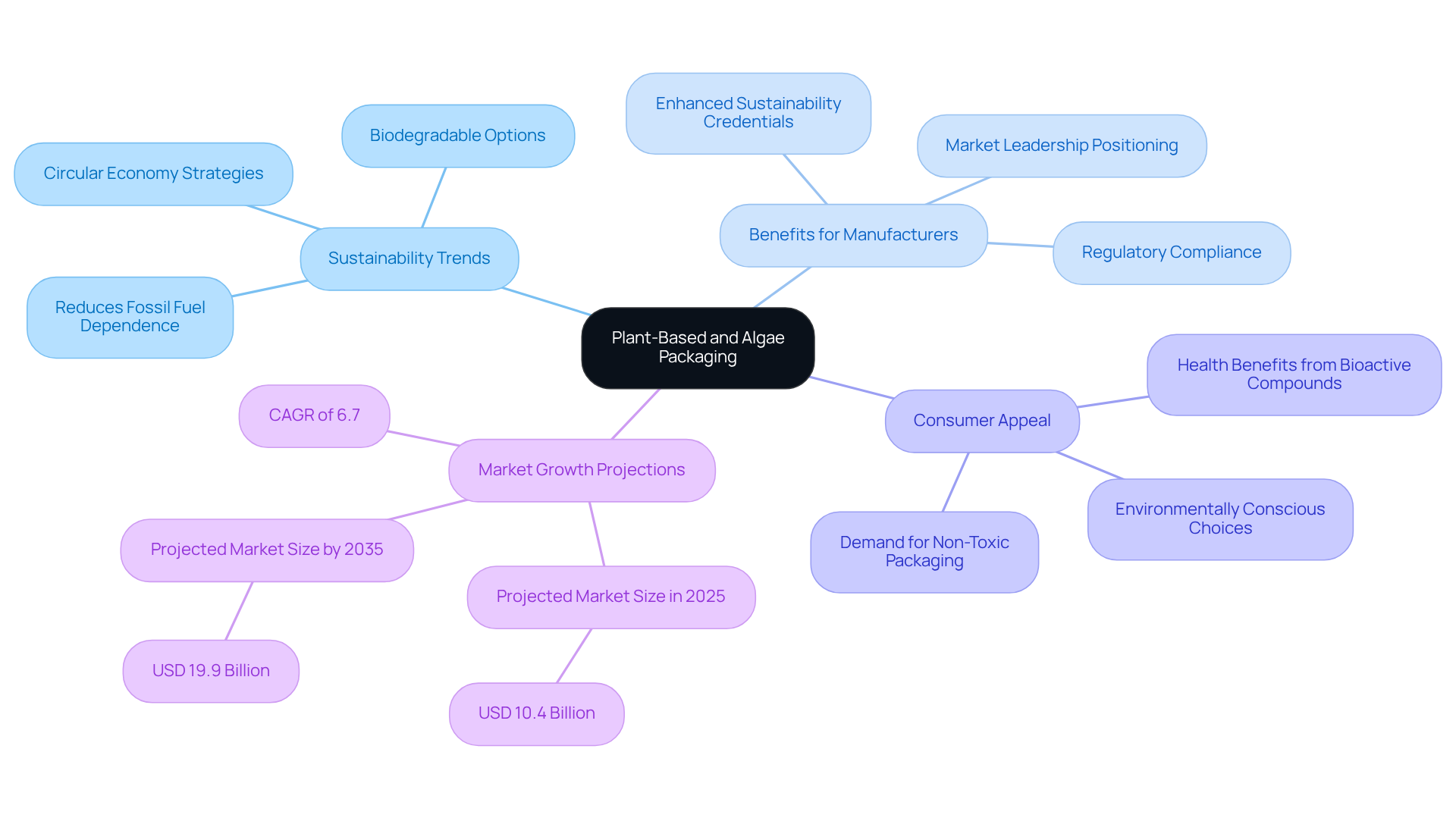

Plant-Based and Algae Packaging: Innovative Sustainable Materials

The emergence of plant-based and algae materials in packaging highlights key packaging sustainability trends, representing a significant advancement towards sustainability and offering a compelling alternative to traditional plastics. These innovative materials not only diminish our dependence on fossil fuels but also provide biodegradable options that resonate with environmentally conscious consumers.

Nutraceutical manufacturers have a unique opportunity to leverage these materials, thereby enhancing their sustainability credentials while simultaneously fulfilling regulatory requirements. By adopting plant-based and algae packaging, brands can assert their leadership in the transition towards packaging sustainability trends, ultimately positioning themselves at the forefront of this vital industry shift.

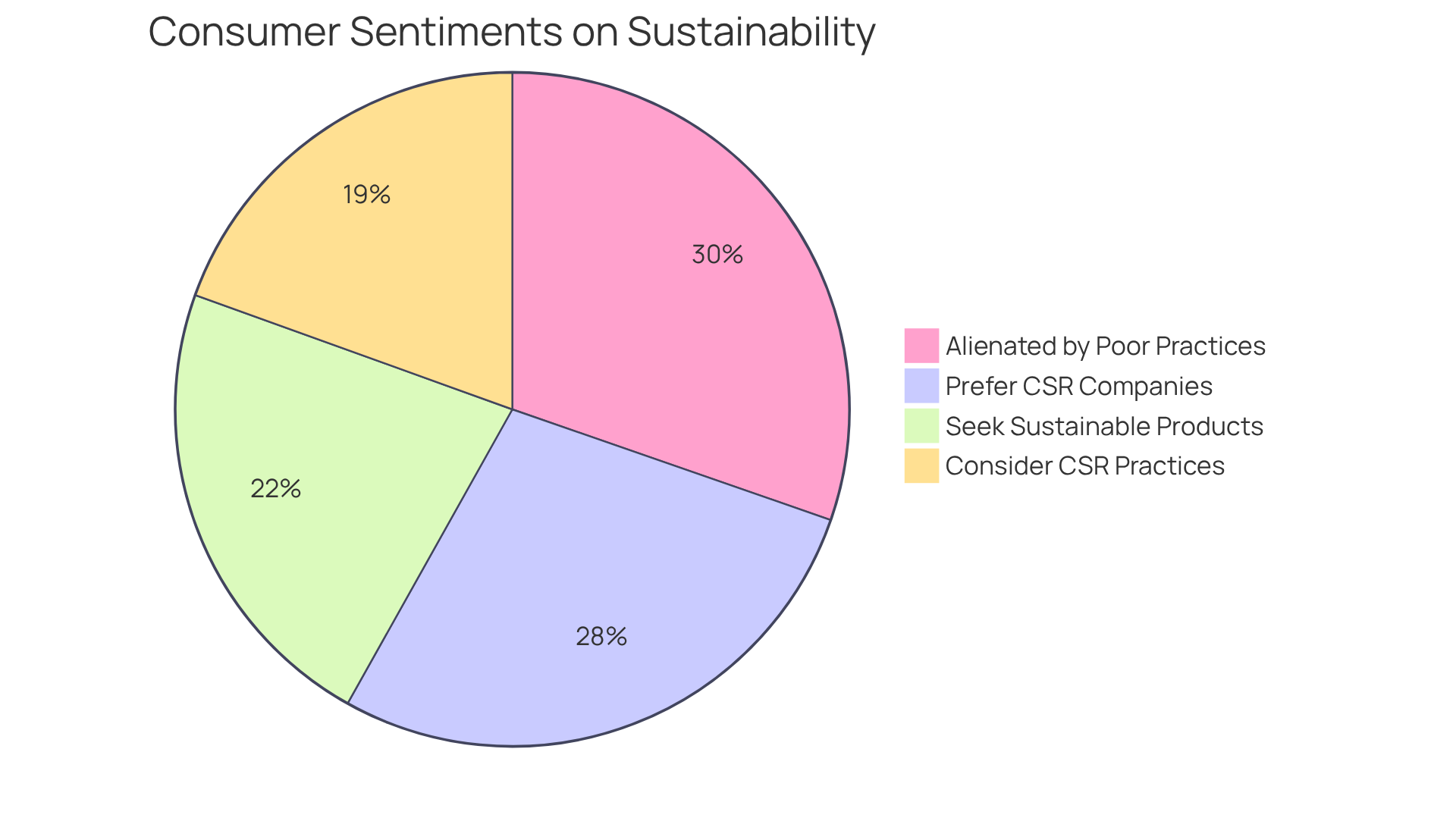

Sustainability Certifications and Transparency: Building Consumer Trust

Sustainability certifications are pivotal in cultivating trust among buyers in the health product market. By securing certifications that validate sustainable practices, brands effectively convey their commitment to environmental responsibility. Clarity in sourcing and production methods is increasingly significant to shoppers; 62% of U.S. adults frequently seek sustainable products, highlighting a growing trend in purchasing behavior. Furthermore, 84% of customers assert that poor environmental practices will alienate them from a brand, underscoring the repercussions of neglecting sustainable practices.

By prominently displaying certifications on packaging, nutraceutical manufacturers can enhance their credibility and attract environmentally conscious shoppers. Brands engaged in Corporate Social Responsibility (CSR) initiatives witness a marked increase in customer loyalty, with 77% of individuals preferring to purchase from these companies. Additionally, 54% of global shoppers consider a company's CSR practices when making purchasing decisions.

As the market evolves, those prioritizing packaging sustainability trends and transparency are poised to lead in forging enduring consumer relationships.

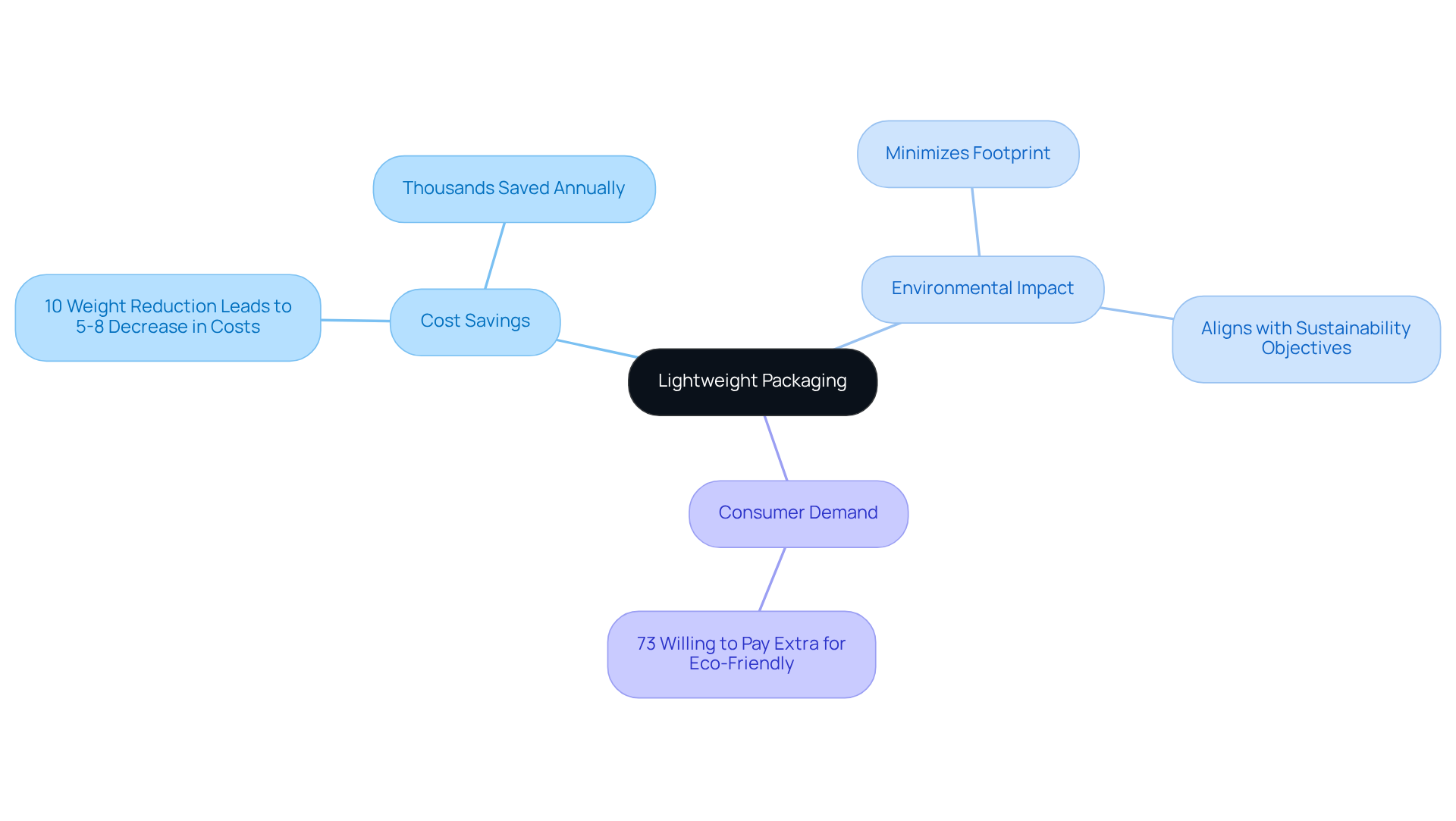

Lightweight Packaging: Reducing Material Usage and Costs

Lightweight materials are rapidly gaining traction among nutraceutical manufacturers, significantly reducing material usage and lowering shipping costs. By adopting thinner materials and optimizing container designs, companies can effectively minimize their environmental footprint while enhancing operational efficiency. This strategy aligns seamlessly with sustainability objectives and resonates with budget-minded individuals.

In fact, a 10% reduction in container weight can lead to a 5-8% decrease in transportation expenses, resulting in substantial savings for high-volume producers. Shaving just a few ounces off each shipment can accumulate to thousands of dollars saved annually in fuel charges, freight rates, and last-mile delivery expenses.

As buyer demand for eco-friendly solutions continues to rise, lightweight containers emerge as a practical method for brands to meet both market expectations and regulatory standards. Experts emphasize that the 'reduce' concept is essential in achieving these goals, advocating for designs that utilize the least amount of material necessary without compromising product integrity. Notable examples include innovative bottle designs that are 60% lighter than traditional formats, such as the award-winning design recognized with the World Beverage Innovation Award in 2018 for Best Closure, showcasing resilience while significantly cutting material costs.

Furthermore, 73% of worldwide consumers are prepared to pay extra for products that arrive in eco-friendly materials, further supporting the shift towards lightweight solutions. As the packaging landscape evolves, packaging sustainability trends towards lightweight solutions are set to influence the future of health supplement packaging in 2025 and beyond.

Sustainability in Supply Chain Practices: Optimizing Operations Responsibly

Sustainability in supply chain practices, particularly regarding packaging sustainability trends, is crucial for nutraceutical producers aiming to optimize operations responsibly. By embracing eco-friendly sourcing, minimizing waste, and enhancing logistics efficiency, companies can significantly reduce their environmental footprint.

Western Packaging's comprehensive 3PL services offer tailored solutions that improve:

- Warehousing

- Inventory management

- Logistics

This empowers producers to implement sustainable practices throughout their supply chain. This approach not only bolsters brand reputation but also addresses the increasing consumer demand for transparency and accountability.

As sustainability regulations become more stringent, manufacturers that prioritize packaging sustainability trends, supported by Western Packaging's expertise, will be strategically positioned to excel in the evolving market.

Conclusion

The evolving landscape of nutraceutical packaging is increasingly defined by sustainability, with manufacturers recognizing the critical importance of integrating eco-friendly practices into their operations. The trends outlined in this article highlight a collective shift towards innovative solutions that not only meet consumer expectations but also contribute to a healthier planet. By prioritizing sustainable packaging strategies, businesses can enhance their brand image while navigating the complexities of modern consumer demands.

Key insights from the article illustrate the multifaceted nature of sustainability in packaging—from the adoption of circular and compostable materials to the implementation of minimalist designs and smart technologies. Each trend emphasizes the necessity for manufacturers to adapt and innovate in response to growing environmental concerns. Furthermore, the integration of sustainability certifications fosters consumer trust, encouraging loyalty and repeat purchases in a competitive market.

In conclusion, the commitment to sustainable packaging is not merely a trend but a vital evolution for the nutraceutical industry. As the market continues to expand, manufacturers must embrace these sustainability practices to not only align with consumer preferences but also to lead the charge towards a more responsible and sustainable future. The call to action is clear: investing in sustainable packaging solutions today is essential for long-term success and environmental stewardship in the nutraceutical sector.

Frequently Asked Questions

What integrated solutions does Western Packaging offer for sustainable packaging?

Western Packaging provides expert design, filling services, and third-party logistics (3PL) tailored to the nutraceutical industry, optimizing the supply chain while incorporating packaging sustainability trends.

How does Western Packaging manage the lifecycle of packaging?

Western Packaging manages the entire lifecycle of packaging from initial design to final distribution, enabling manufacturers to minimize waste and enhance operational efficiency.

What are the benefits of the 3PL services provided by Western Packaging?

The extensive 3PL services, including warehousing and inventory management, streamline the supply chain, allowing businesses to focus on their core competencies.

What is the projected growth of the nutraceutical container market?

The nutraceutical container market is projected to reach USD 4.66 billion by 2030, growing at a CAGR of 4.9%.

How do circular packaging solutions contribute to sustainability?

Circular packaging solutions minimize waste by ensuring materials can be reused, recycled, or composted, thereby reducing the environmental impact and aligning with consumer expectations for sustainability.

What is the significance of Extended Producer Responsibility (EPR) initiatives?

EPR initiatives encourage producers to adopt recyclable and reusable materials, fostering a culture of sustainability in the sector.

What consumer interest exists regarding reusable packaging materials?

Experts note that 85% of consumers indicate an interest in purchasing products packaged in reusable materials.

What is the projected growth of the circular container market?

The circular container market is expected to expand at a CAGR of 7.3% from 2025 to 2034, reaching USD 499.8 billion by 2034.

What is driving the demand for compostable and biodegradable packaging in the nutraceutical sector?

The increasing environmental consciousness among consumers is driving the demand for compostable and biodegradable materials, which help minimize landfill waste.

Can you provide examples of brands utilizing sustainable packaging?

Notable examples include Seed's Sustainable Refill Program and B.A.R.E. Soaps, which use plantable seed paper materials.

Why is it important for brands to offer disposal guidelines for their containers?

Providing clear disposal guidelines helps build consumer confidence and ensures appropriate disposal, aligning with packaging sustainability trends.

What is the market potential for biodegradable materials?

The worldwide biodegradable container market is anticipated to grow from around $80.76 billion in 2024 to $132.86 billion by 2032.