Overview

This article provides a comprehensive comparison of leading packaging companies in the USA specializing in nutraceuticals, spotlighting key players such as:

- Berry Global

- Amcor

- WestRock

- Mondi

These companies offer unique solutions tailored to the health supplement market. Sustainability, innovation, and integrated services are paramount in packaging solutions today. Companies that align their capabilities with industry demands not only enhance operational efficiency but also attract health-conscious consumers. By emphasizing these critical factors, the article underscores the importance of choosing reliable packaging partners in a competitive landscape.

Introduction

The nutraceutical packaging industry stands on the precipice of a significant transformation, driven by an escalating consumer emphasis on health and wellness. With market projections nearing $10 billion by 2035, the necessity for innovative and sustainable packaging solutions has never been more pressing. This article examines the leading packaging companies in the USA, highlighting their distinctive offerings and their approaches to the challenges of product integrity, sustainability, and evolving consumer preferences. In a landscape brimming with options, which company truly excels in catering to the specific demands of nutraceutical brands?

Overview of Leading Packaging Companies in the USA

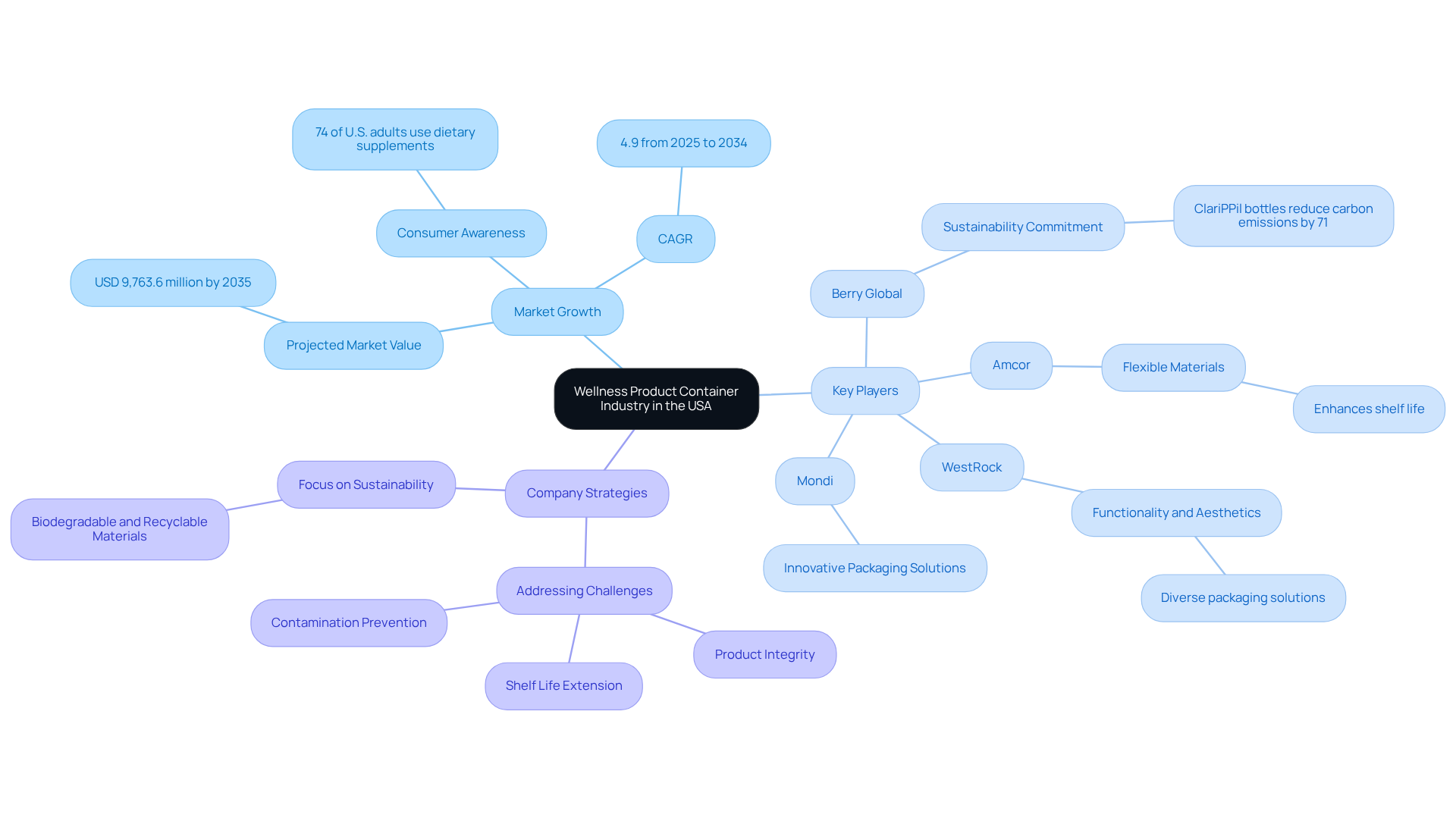

The wellness product container industry in the USA is experiencing significant growth, projected to reach USD 9,763.6 million by 2035, with a compound annual growth rate (CAGR) of 4.9% from 2025 to 2034. This expansion is largely driven by heightened consumer awareness of health and wellness, as evidenced by 74% of U.S. adults reporting the use of dietary supplements.

Key players in this market, categorized as packaging companies in the USA, include:

- Berry Global

- Amcor

- WestRock

- Mondi

Each is recognized for their innovative packaging solutions tailored to the specific needs of health supplements. Notably, Berry Global distinguishes itself through its commitment to sustainability, exemplified by its ClariPPil bottles, which reduce carbon emissions by approximately 71% compared to traditional alternatives. Amcor prioritizes flexible materials that enhance shelf life, addressing the growing demand for convenience and durability. WestRock merges functionality with aesthetics, offering a diverse array of packaging solutions that resonate with nutraceutical brands.

These companies not only contribute to the industry's advancement but also play a crucial role in tackling challenges related to product integrity, shelf life extension, and contamination prevention—elements essential for preserving the efficacy of nutraceuticals. Furthermore, the dietary supplements segment is anticipated to exceed USD 2.5 billion by 2034, underscoring the robust growth of this market.

Service Offerings: Packaging Design, Filling, and Logistics

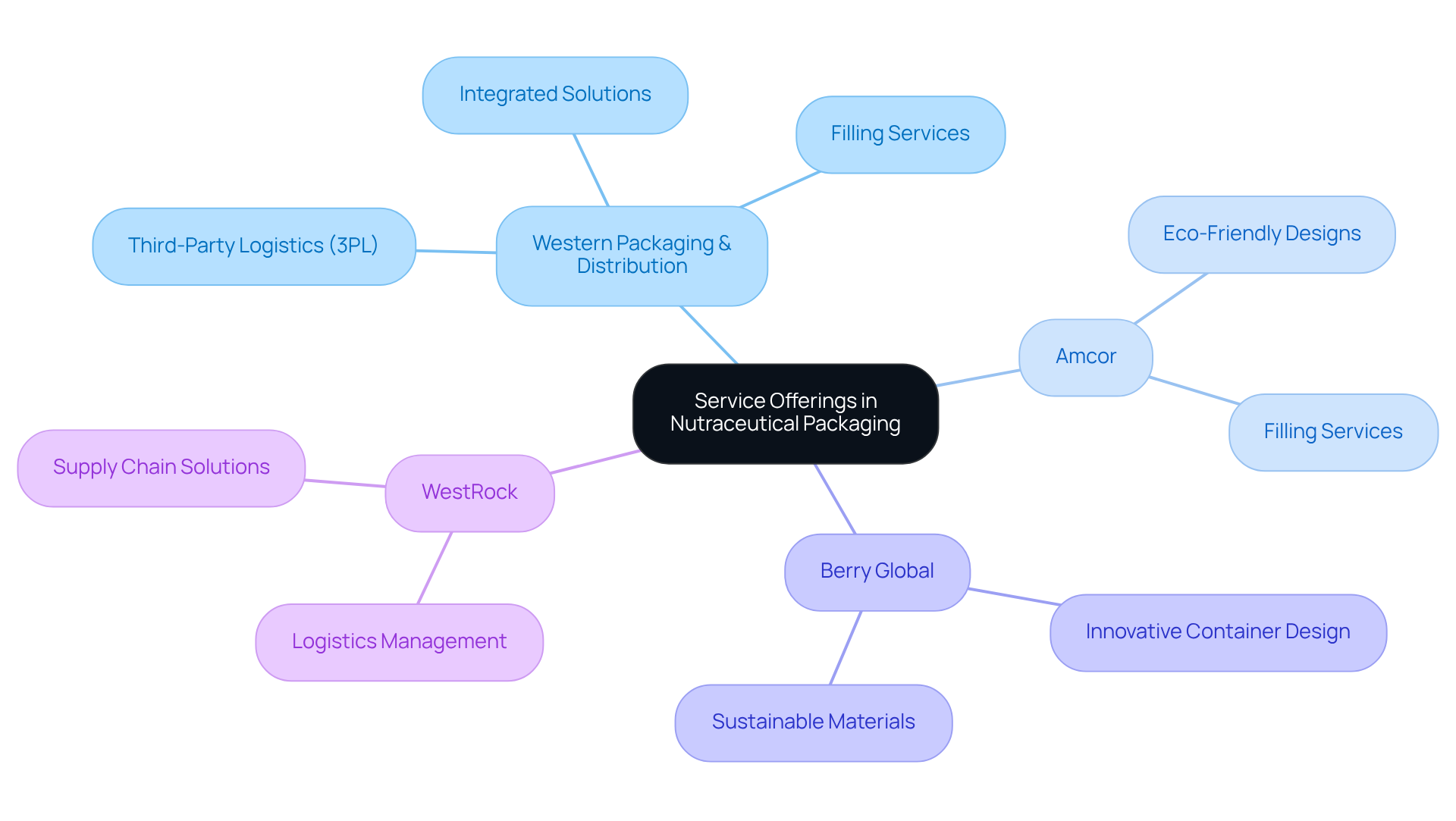

Leading packaging companies in the USA provide a diverse array of services specifically tailored for the nutraceutical sector. Notably, among the packaging companies in the USA, Western Packaging & Distribution sets itself apart by offering integrated solutions that seamlessly merge container design, filling services, and third-party logistics (3PL). This cohesive approach not only streamlines operations but also significantly enhances efficiency for clients.

Conversely, packaging companies in the USA, such as Amcor and Berry Global, focus on innovative container design and sustainable materials, while also delivering filling services customized for various product types. For instance, Amcor has prioritized eco-friendly container solutions, which are increasingly vital in today’s market. WestRock places emphasis on logistics and supply chain management, ensuring timely delivery and effective inventory oversight.

This diversity in service offerings empowers businesses to select a provider that best meets their operational needs. Importantly, the dietary supplement container sector, driven by packaging companies in the USA, is projected to grow at a CAGR of 5.6% from 2025 to 2030, indicating a significant shift towards integrated solution designs.

Recent advancements in the nutraceutical field underscore the importance of filling services, with case studies from Western Packaging illustrating successful implementations that address the unique requirements of nutraceutical products. Industry experts assert that such integrated solutions are essential for preserving item integrity and meeting consumer demands in a competitive landscape, with 70% of customers admitting they purchase a product solely based on its presentation.

Differentiators: What Sets Each Company Apart

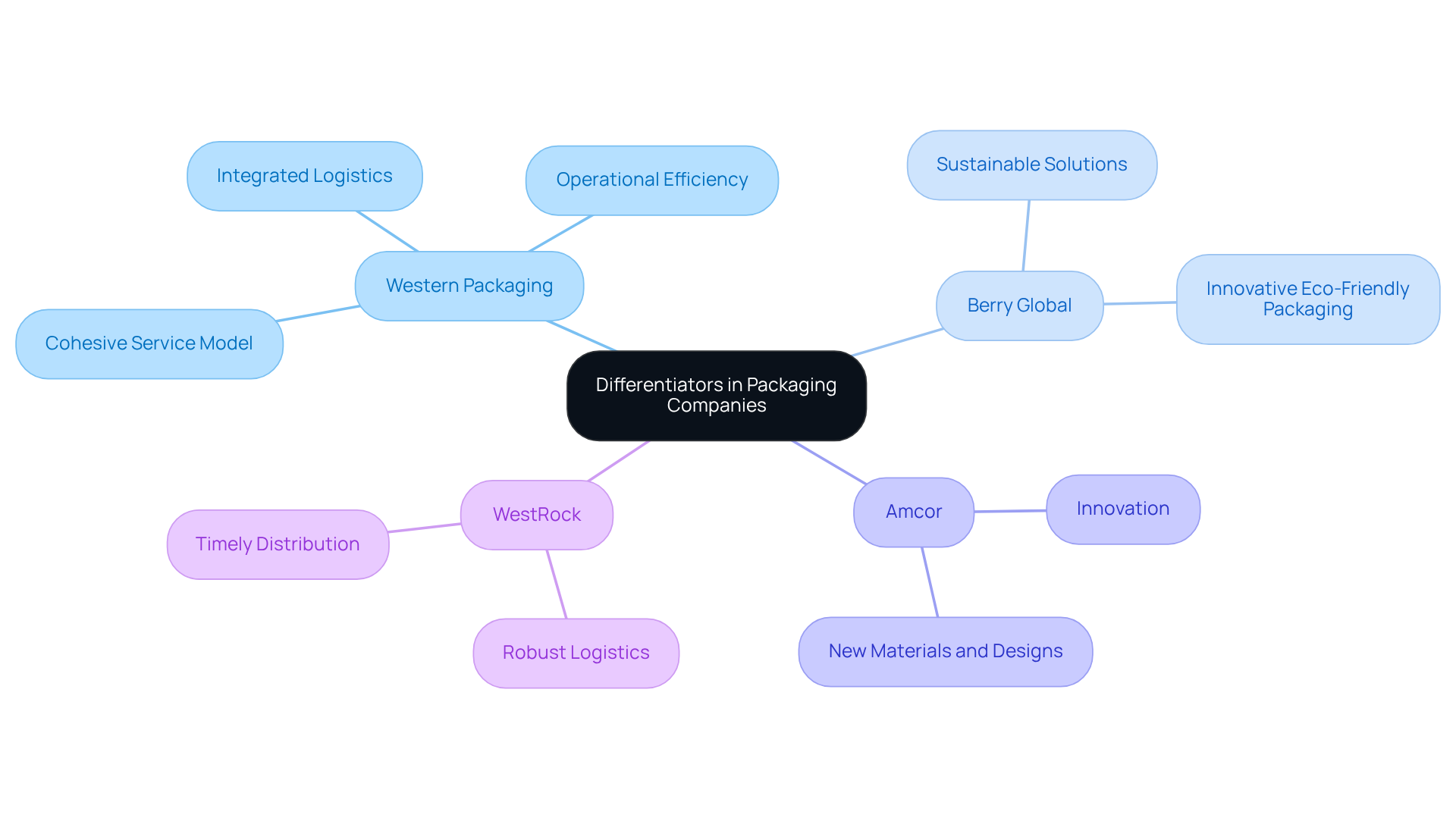

In the competitive landscape of packaging companies in the USA, each player possesses distinct differentiators that enhance their market presence. Western Packaging stands out with its integrated approach to distribution and logistics, streamlining the supply chain for clients. This significantly reduces lead times and enhances product delivery. Such a cohesive service model not only optimizes operational efficiency for packaging companies in the USA but also empowers them to concentrate on their core competencies.

Consumer preferences are increasingly shifting towards sustainable wrapping solutions, a trend that Western Packaging wholeheartedly embraces through its commitment to eco-friendly practices. Industry leaders emphasize that sustainability is not merely a trend but an essential principle, particularly among packaging companies in the USA, with quotes highlighting the importance of environmental stewardship in product delivery. For instance, the demand for sustainable materials is echoed by packaging companies in the USA like Berry Global, recognized for its innovative eco-friendly packaging options that resonate with environmentally conscious consumers.

Amcor distinguishes itself with a strong emphasis on innovation, consistently launching new materials and designs that enhance visibility and shelf appeal. Meanwhile, WestRock capitalizes on its robust logistics capabilities, ensuring timely and efficient distribution for its clients.

These differentiators not only enhance the visibility of packaging companies in the USA but also influence client choices based on specific requirements, especially in the health supplement industry, where operational efficiency and sustainability are essential.

Industry Suitability: Matching Companies to Your Needs

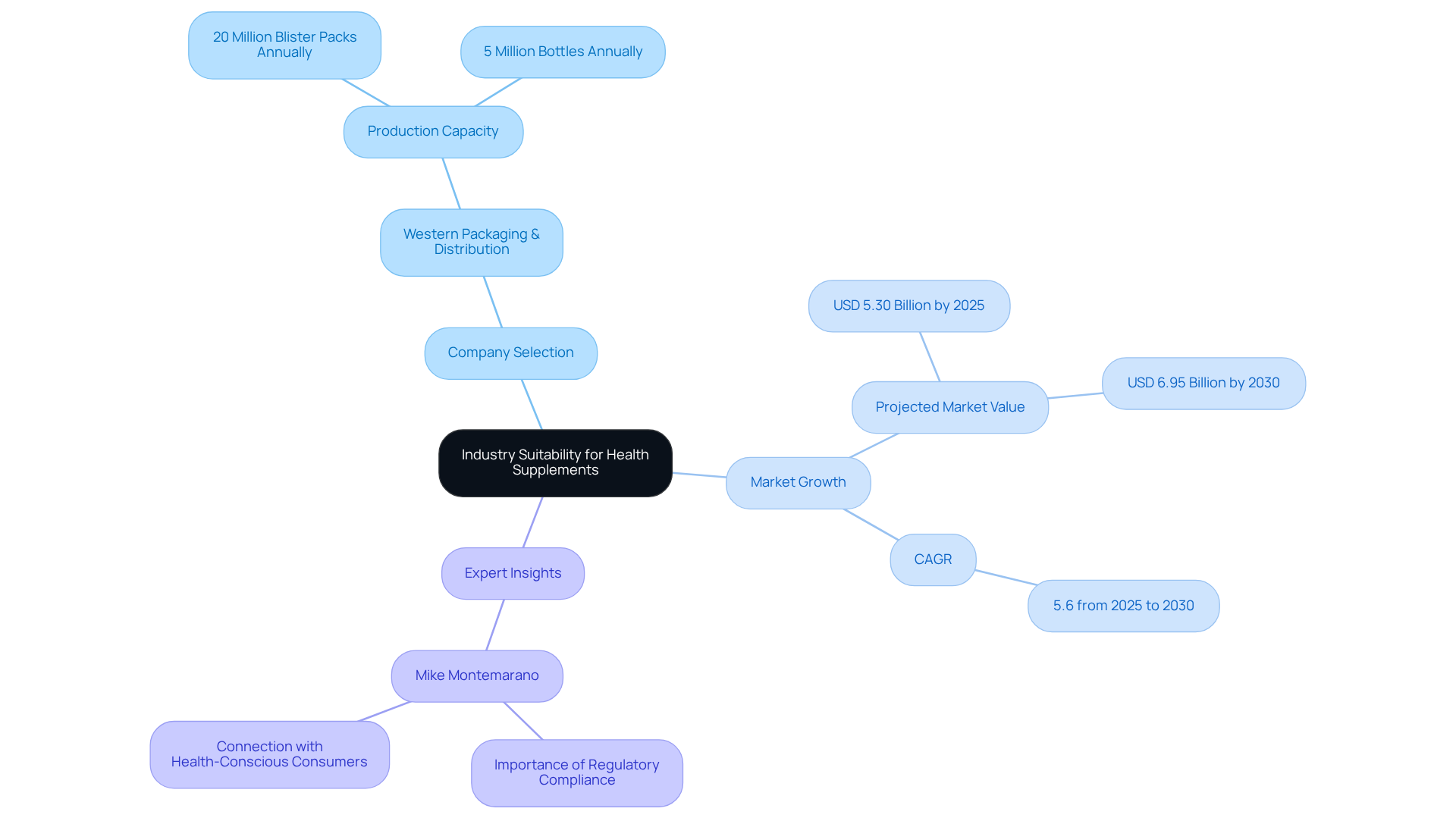

Selecting the appropriate firm for containers is crucial for the success of health supplements. Companies such as Western Packaging & Distribution distinguish themselves through their extensive service offerings, which include filling and logistics tailored specifically for dietary supplements. Their facility boasts the capacity to fill up to 20 million blister packs annually and 5 million bottles, ensuring efficient production and delivery times as swift as three weeks. This capability is particularly beneficial for brands aiming to meet the rising demand in the nutraceutical sector, projected to reach approximately USD 5.30 billion in 2025 and around USD 6.95 billion by 2030, expanding at a CAGR of 5.6% from 2025 to 2030.

By aligning the right collaborator with specific industry demands, companies can optimize their operations, enhance product appeal, and significantly bolster their market presence. As industry expert Mike Montemarano noted, "By selecting packaging companies in USA that understand the unique needs of nutraceuticals, businesses can guarantee their offerings not only comply with regulatory standards but also connect with health-conscious consumers." This strategic alignment is vital in a competitive landscape where consumer health awareness is propelling demand for high-quality nutraceutical products.

Conclusion

The evolving landscape of the nutraceutical packaging industry in the USA showcases a dynamic market driven by consumer demand for health and wellness products. With projections indicating a growth to nearly USD 10 billion by 2035, leading packaging companies are rising to meet the unique challenges and needs of this burgeoning field. By emphasizing sustainability, innovative design, and integrated service offerings, companies such as Berry Global, Amcor, WestRock, and Western Packaging & Distribution are not only enhancing their competitive edge but also contributing to the overall growth and integrity of the nutraceutical market.

This article highlights critical differentiators among these packaging firms, illustrating how each company tailors its solutions to address specific client needs.

- Berry Global's dedication to eco-friendly practices

- Amcor's innovative materials

- WestRock's logistics expertise

- Western Packaging's comprehensive service model

Exemplify the diverse strategies employed to capture market share. As consumer preferences increasingly lean towards sustainable and visually appealing packaging, these companies are well-positioned to adapt and thrive in a competitive environment.

Ultimately, the choice of a packaging partner can significantly impact the success of nutraceutical brands. By aligning with companies that grasp the nuances of the industry, businesses can enhance their operational efficiency, ensure compliance with regulations, and appeal to health-conscious consumers. As the nutraceutical market continues to expand, the importance of selecting the right packaging provider cannot be overstated. It is essential for stakeholders to consider the unique strengths and offerings of each company to effectively meet their needs.

Frequently Asked Questions

What is the projected growth of the wellness product container industry in the USA?

The wellness product container industry in the USA is projected to reach USD 9,763.6 million by 2035, with a compound annual growth rate (CAGR) of 4.9% from 2025 to 2034.

What factors are driving the growth of the wellness product container industry?

The growth is largely driven by heightened consumer awareness of health and wellness, with 74% of U.S. adults reporting the use of dietary supplements.

Who are the key players in the packaging market for health supplements in the USA?

Key players in the market include Berry Global, Amcor, WestRock, and Mondi.

What distinguishes Berry Global from other packaging companies?

Berry Global is recognized for its commitment to sustainability, exemplified by its ClariPPil bottles, which reduce carbon emissions by approximately 71% compared to traditional alternatives.

How does Amcor enhance its packaging solutions?

Amcor prioritizes flexible materials that enhance shelf life, addressing the growing demand for convenience and durability in packaging.

What approach does WestRock take in its packaging solutions?

WestRock merges functionality with aesthetics, offering a diverse array of packaging solutions that resonate with nutraceutical brands.

What challenges do these packaging companies help address in the nutraceutical industry?

These companies play a crucial role in tackling challenges related to product integrity, shelf life extension, and contamination prevention, which are essential for preserving the efficacy of nutraceuticals.

What is the anticipated market value for dietary supplements by 2034?

The dietary supplements segment is anticipated to exceed USD 2.5 billion by 2034, highlighting the robust growth of this market.